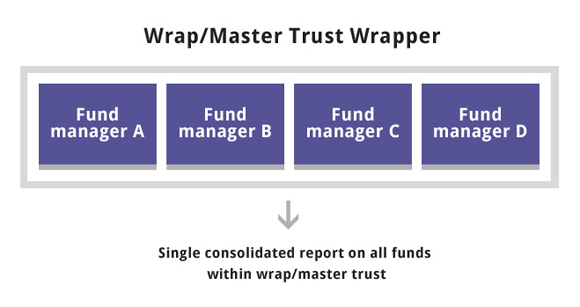

Wraps and master trusts were initially developed as a wrapper to managed funds to simplify reporting on and managing your investments. Although they differ in their legal structure, their primary differences lie in what they allow you to invest in.

A master trust is an investment wrapper allowing you to invest in a range of managed funds within the wrapper and can be perceived as a fund supermarket allowing you to pick and choose from a wide range of managed funds within a “one stop shop”.

A wrap account is a very similar product allowing you to invest in managed funds but also includes direct investments like shares and property.

The main benefit of Wraps and Master Trusts is consolidated reporting of all your managed funds and/or shares and property investments. Rather than receiving and tracking your investments through several end of year tax statements or web logins a Wrap or Master Trust simplifies your reporting by providing you with one login and statement across all your assets held within the wrapper.

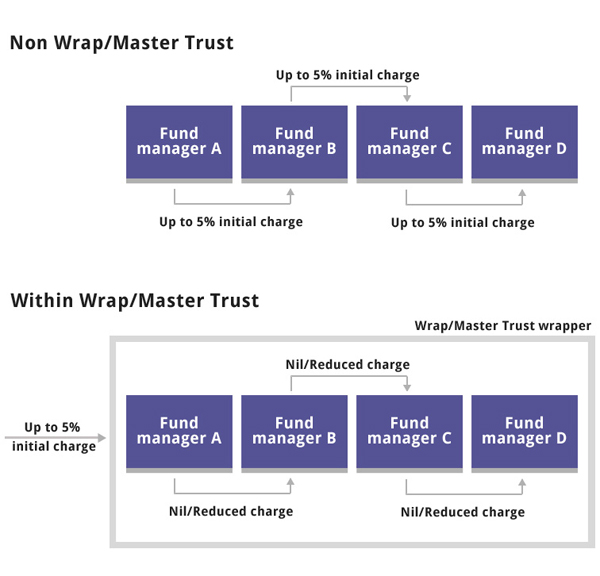

Grouping investors managed funds within wraps can impact on charges

Although Master Trusts and Wraps have another set of management fees on top of investing in just the underlying managed funds, in many cases Master Trusts and Wraps also reduce the underlying management fees.

Wrap and Master Trust providers reduce the administration burden on managed fund providers and are therefore able to negotiate reduced wholesale rates. In many cases this allows you to access funds with the added benefits of wraps and master trusts at a similar overall level of fees to that charged by the underlying retail fund.

However, some financial planners see this as an opportunity to increase their commission payments further rather than passing on this benefit to you.

Whether you’re looking to invest into or have an existing Wrap and/or Master Trust, contact us to reduce your annual management fees