ANZ has just announced the launch of its new hybrid security, CPS 2. The first round of funding is open through a broker firm allocation, prior to general offer and institutional offer before listing in December.

The securities will be rated A+ by agency Standard & Poor’s meaning they are an investment grade hybrid considered relatively low risk.

CPS 2 will pay a quarterly coupon of between 3.10% and 3.30% over the 90 day bank bill swap rate (BBSW), currently 3.90%, with exact pricing to be set prior to launch.

CPS 2 has a 7 year term, after which, shares will automatically convert to ANZ ordinary shares, as long as the prescribed conditions are met.

Anticipated 2% premium to the issue price

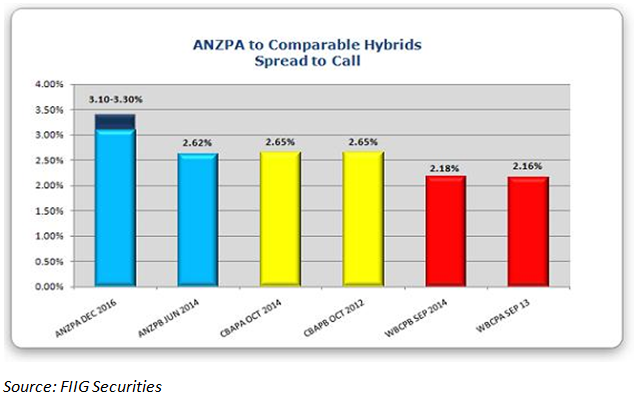

An analysis based on other hybrids in the market shows that other comparable securities were trading at a spread of around 2.62%-2.65%.

Similar to other recent issues, we feel that the market can realistically value ANZ CPS 2 at $204-$205, a 2-2.5% premium to the issue price. In addition to this CPS 2 shareholders receive a 1% discount to the ANZ share price on conversion.

Other major bank hybrids are currently trading at spreads of less than the indicative range for the CPS 2 which indicates there will be strong demand for this issue.

The chart below outlines the current trading spreads for major bank converting preference share issues.

Investors should note that while the margin is quoted as a spread over BBSW, the cash amount of any income payable will be a lower amount. Income levels quoted are grossed up and payments received are net of franking credits.

E.g, if the final margin is set at 3.20%. With the BBSW currently around 3.90%, the indicative income is around 7.10%. However, since the payments are fully franked, the actual income will only be 70% of this amount, 4.97%.

The good news for investors is that since the hybrid is a ‘floater’, coupon payments will move in line with changes in BBSW. This figure is highly correlated with official interest rates so as these move higher, as almost certainly will be the case, coupon payments will also increase.

Best regards

Sulieman Ravell

Wealth Focus Pty Ltd

Comment: