Protection when there’s blood on the streets

We have seen some significant falls in the sharemarket over the last 18 months. Increase in investor anxiety over equity investments has in turn seen a huge rise in the demand for capital protected and capital guaranteed products.

This issue’s Back to Basics considers whether now is the time to look for capital protection within your portfolio and what are the differences in the structures currently available?

One of Warren Buffett’s most famous quotes is “Invest and seek out opportunities when there’s blood on the streets”. Well, over the last year our streets have turned red, so on that basis, shouldn’t you be filling your boots? Why pay for downside protection when logic dictates that prices are low? Some would argue that capital protection should be bought in times of a booming economy not after the fact…

Herein lies the problem, the prices in the market are dictated by investor sentiment, if investors feel bullish, then prices are rising, if prices are rising, investors are happy and don’t see a need for protecting their investments.

On the flipside, once prices have fallen, investors head for safety, resulting in a demand for capital protected products. More importantly, capital protection can allow you to leverage and gain exposure to markets that have potential for significant returns without the capital.

So what are you actually buying if investments are going to go up?

Primarily, many of the capital protected products allow you to borrow up to 100% of your investment, allowing you to gain exposure to markets that have potential for significant returns without the capital. However, another major factor is simply, peace of mind. Whether we acknowledge it or not, we’re emotive in our own investment decisions. It’s difficult to feel good about investing in the market when its just fallen by 50% and everyone around you is talking about how much their investments have fallen, it’s far more pleasant to invest when the market has risen 50% and everyone around you is slapping you on the back that you’ve made the right decision and how much they’ve made. As a result, many investors to some extent find themselves investing after they’ve seen significant rises in the market and selling out when the market has fallen.

Time in the market

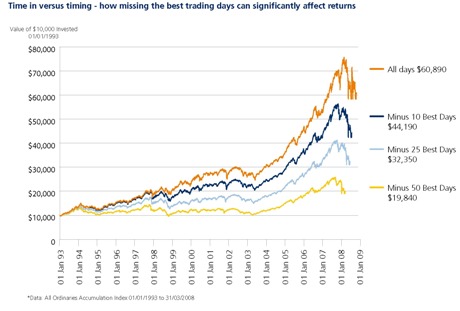

Timing the market is pretty much impossible, missing out on just a few days when the markets turn can significantly reduce your returns, so most experts live by the maxim that its time in the market, not timing the market, that’s the best approach.

|

A win-win situation

What capital protection allows you to do is make that leap safe in the knowledge that you have something to fall back on. It’s a win-win situation, if the market falls further, you feel good about how clever you were to have protection in place and if the market goes up in value you feel good about how clever you were not to have missed the boat. This decoupling of your emotions from your investment decisions means that you are then less likely to fall foe to the herd mentality of buy when times are good and sell when times are bad.

A tale of two structures

- Constant Proportion Portfolio Insurance (CPPI)

- The Bond + Call structure

|

| If the market goes down, more money is switched into bonds and cash | |

| If the market goes up, more money is switched into equities |

Any shortfall at the end of the term is paid for by the CPPI manager.Bond + Call

Bond + Call is packaged product made up of two parts:

| 1. |

A safe asset such as a term cash account or fixed interest bond to produce fixed amount at the end of the term.

|

| 2. | An equity based asset such as a call option or futures which provides magnified returns to the investor. |

| Dynamic Hedging We should also mention Dynamic Hedging, a relatively new product to the retail investor in Australia. This is basically an insurance premium you pay the provider for your protection. The term Dynamic Hedging relates to how they provide the protection, but in essence, you pay an insurance premium, they provide the protection. It is the provider that is exposed to any shortfall. |

Which protection mechanism?

For many, the rule of thumb as to which structure you opt for generally relates to what you want to invest into. Capital protection over managed funds generally has to be with a CPPI or Dynamic Management type structure since you cannot buy options over a managed fund, whilst Bond + Call structures are generally linked to the performance of an index.

| CPPI | Bond + Call | Dynamic hedging | |

| Performance based on | Managed funds | Index | Managed funds |

| Level of participation in gains of underlying investment | Disinvestment with falls or volatility in the market = less than 100% participation | typically 100%-150% |

100% |

| Cost of protection | Much of the cost is implicit. Lower participation rates typically mean this is lower than Bond + Call or Dynamic Hedging | Much of the cost is implicit. Higher participation rates typically mean this will be higher than CPPI | Explicit costing can make this look relatively expensive. Should cost somewhere between CPPI and Bond + Call |

| Investment loan interest rates | Lower participation rates reduces volatility and the cost of borrowing to invest | Higher participation increases volatility and the cost of borrowing | Should work out somewhere between CPPI and Bond + Call |

| Ability to turn on/off protection | No, in-built for term of product | No, in-built for term of product | Yes |

Some of the more well known examples of CPPI are Perpetual’s Protected Investment range (PPI Series) and Macquarie’s Fusion Funds, whereas Bond + Call structures are utilised by Commonwealth Capital Series and a variation of the structure by Man OM-IP.

We’ve written a factsheet for those readers looking for a more detailed explanation of the two structures which can be downloaded from www.fundsfocus.com.au/managed-funds/pdfs/Capital-Protection.pdf

Warren Buffet is also famous for saying “It’s only when the tide goes out that you learn who’s been swimming naked.” With the unprecedented falls that we’ve seen recently, the tide has certainly gone out, and the capital protection mechanisms have been well and truly tested.

CPPI products that have been built of historical performance have not accounted for such dramatic falls in the market. Whilst the protection mechanism of disinvesting as the funds fall in value have worked, an anomaly of this type of structure means that funds that have moved 100% into cash can no longer have any exposure to equity performance. Perpetual’s awarded PPI Series are a case in point, the majority of funds launched over the last 18 months have cashed out, leaving investors sitting in cash for the next 5-6 years. Macquarie’s Fusion funds have the benefit of never completely cashing out, but once your holding is reduced to their minimum of around 3%, the underlying investment fund needs to rise by a factor of at least 2-3 times before you become fully reinvested again. Investors sitting in these situations would do well to consider cashing in and reinvesting.

Please don’t think CPPI is all doom and gloom, these products have done their job, investments made into these products haven’t fallen anywhere near as much as the underlying equity fund and the structure has allowed many to borrow 100% of their investment. However, this is definitely a shortcoming of this type of structure and we wouldn’t be surprised to see a radical restructure of the current offers out there in the hope of retaining clients who are cashed out so early.

By contrast Bond + Call products such as Commonwealth Capital Series, Macquarie Gateway, Macquarie Equinox and Man OM-IP’s range of funds have not disinvested and allow investors to fully participate in the market when it finally bounces back.

We feel that two of the more interesting offers currently available are the latest Commonwealth Capital Series Australia and Man OM-IP 220 2008.

Man OM-IP’s success has always been its ability to provide returns in both a falling and rising market. Using a variation of the Bond + Call structure, the products use a mixture of their core AHL fund to produce returns from trends in both rising and falling markets and a managed fund that helps to reduce the overall volatility of the structure.

Capital Series Australia is ideal for those that feel that with the market at such a low level, now is an opportunity to invest. This is a simple Bond + Call structure, giving investors gains from a rise in the ASX 200 and a Capital Guarantee from Commonwealth Bank.

Alternatively, investors looking to invest into managed funds or like the idea of being able to switch off their protection should look at Axa North which allows you to bolt on “protection”. The added benefit of being able to turn off, or reset the protection if investments rise significantly, is definitely worth considering.

Comment: