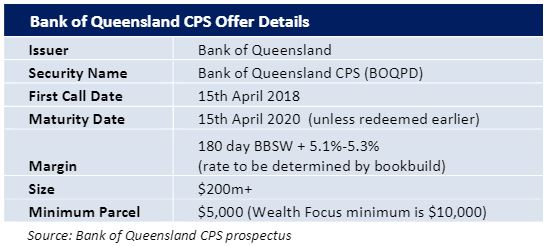

Bank of Queensland has just announced the launch of a new income offer: Bank of Queensland Convertible Preference Shares (CPS).The first round of access is through a broker firm allocation, prior to shareholder offer and listing in December.

The Shares will pay a semi annual coupon of 5.1%-5.3% (rate determined by the bookbuild) over the 180 day bank bill swap rate (BBSW), which was 3.25% as of 13th November, with an initial indicative rate of 8.33%-8.53%pa. (The first pricing is due to be set on date of issue) The Shares are expected to redeem on the 15th April 2018*. The Shares will be tradable on the ASX.

Background to Bank of Queensland

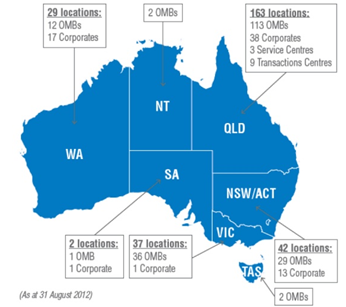

Bank of Queensland is capitalised at $2.3 Billion, an ASX 100 listed company and is one of the largest regional banks with a network of 277 locations.

Focus on loan book

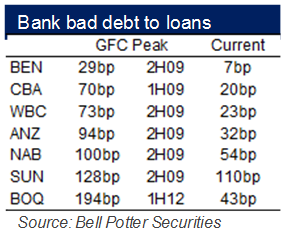

As we have previously highlighted, post GFC, one of the main concerns with any bank is its lending practices and the history of bad debts. This is particularly pertinent when looking at BOQ since they are the first Australian bank to have posted a full year net loss in 20 years. The concern is a weaker economy would lead to increased defaults and the view is that banks with historically high bad debt ratios are more likely to suffer in an economic downturn.

If you have read our analysis of the recent Bendigo Bank issue you would have noted that BOQ bad debt to loans was relatively high at 194bp. However, this is likely to have been new management clearing the decks resulting in the first reported loss by an Australian Bank in 20 years. We find it somewhat reassuring that the recent results have shown this normalising in line with other major lenders at 43bps, but BOQ’s historically high bad debt ratios are a definite concern and flag the risk of investing in Bank of Queensland.

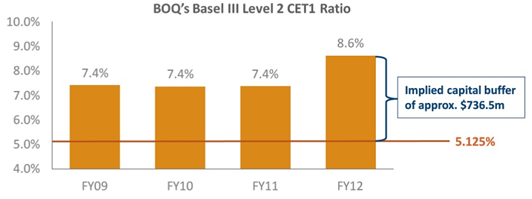

Tier 1 capital ratio

Another consideration is the level of tier 1 capital ratio that the bank holds. In layman’s terms this can be considered to be the level of cash held versus the bank’s loan book. The higher the ratio, the greater the buffer the bank has.

Of note, BOQ now has a Common Equity Tier 1 Capital Ratio of 8.6%, the highest of its banking peers, and provides some reassurance and buffer to the 5.125% Common Equity Trigger event that APRA now insists these hybrid issues contain.

Comparative Securities

This closest comparables are arguably SUNPC and BENPD in that BOQ is not one of the big four, and these securities all contain non-viability clauses that convert the hybrids into ordinary shares in the event of that either the tier 1 capital ratio falls below 5.125% and/or APRA views that the company is no longer viable and as such commands a premium to historical margins.

We should warn against looking to Bank of Queensland PEPS (BOQPC) that are currently trading on market and were due to mature this month. The temptation is to look at the historical trading margin on these securities as a gauge of how this new issue will trade on market. Indeed, these were trading at a tighter margin than Commonwealth Bank Perls V for much of this year and could easily be mistaken as reflecting a view of lower risk when the market had already priced in a possibility that BOQPC may be redeemed in December this year.

Overall, with a margin of 5.1%-5.3% over the BBSW, BOQPD reflects the higher risk associated with smaller banks and investors would do well to remember this.

Existing Bank of Queensland PEPS investors (BOQPC)

Existing investors (as of 9th November) in BOQPC are being given the opportunity to roll their investment into the new Bank of Queensland CPS at $100 face value. This is a relief for existing investors as the BOQ share price was trading well below the mandatory conversion conditions, leaving BOQPC holders in limbo as to whether the shares would be redeemed or continue in perpetuity. Advocates of hybrids have long pointed to a clause allowing Bank of Queensland to apply to APRA to repay these at their discretion and that etiquette dictated that banks repaid these at the first opportunity. We feel that the recent reported loss would have made this an unlikely alternative and by allowing BOQPC shareholders to roll into the new issue, they have circumvented a problematic outcome and maintained their reputation in the credit markets.

Existing investors in BOQPC should therefore note that they have little choice than to roll into the new BOQ CPS issue and receive a $100 face value on a new issue paying 5.1% over the BBSW.

Investors remaining in the previous BOQPC are likely to see the value of the investment fall significantly as they are now holding a perpetual note paying 2% over BBSW in a 2nd tier bank. You only have to look towards NAB Perpetual, NABHA (1% over BBSW), to see how perpetual can trade significantly below their face value.

As a result, we would expect BOQPC to end up trading around $80.

Key Points

- Indicative floating yield of 8.33%-8.53% provides investors the opportunity to take advantage of historically high hybrid margins.

- Option to redeem at year 5 with mandatory conversion at year 7 – Bank of Queensland has the option to convert in April 2018 or on any subsequent dividend payment date.

- Financial Strength – Bank of Queensland provides investors with exposure to an ASX 100 listed company and a market cap of $2.3bn.

- Automatic conversion under the Capital Trigger Event –we encourage you to be familiar with this clause as it is the reason that this hybrid structure requires a higher margin for investors to consider investing

- Redemption highly likely in 5 years – although BOQPD has a 7 year maturity, we think BOQ will redeem/convert at the first call date in April 2018.

As we have highlighted on previous hybrid issues, there are major incentives for redemption/conversion. These include the potential for reputational damage and risk of credit rating downgrade, leading to an increased cost of funding on future debt issues.

- New management team – The longest serving board member is only 7 months. Considering BOQ’s recent losses, this could either be a disaster waiting to happen or a new lease of life.

- Recent write downs viewed as attractive – From a hybrid perspective, investing after the recent write downs and losses is arguably attractive as you’re being rewarded with a higher margin and the skeletons have been aired.

We p that Bank of Queensland have highlighted they are looking for $200 Million on this issue. Considering there are $200 Million of BOQPC available to roll into this new issue, we would guess that BOQ are really looking for more than $300-$400 Million.

Our View

This is really an exercise in rolling investors into an issue that complies with the new APRA requirements. Existing investors with BOQ PEPS (BOQPC) would be mad not to roll into the new issue. Investors sitting tight are likely to see the value of their investment fall. As a result we may see some initial weakness on listing as those investors who are only using BOQPD as an escape vehicle to jump ship.

Having said that, we are hearing there is huge demand for this issue as investors clamber for a high 5.1%-5.3% (+ 180 BBSW) margin. We are in no doubt that this will come in at the 5.1% margin but the question is whether BOQ will take everything on the table.

We have always flagged the non-viability/capital trigger clauses as our concern with these issues and we avoid them within our client portfolios, but if you’re of the view that BOQ isn’t going out of business soon, 5.1% over the BBSW seems attractive and fairly priced relative to other similar issues on market.

The downside of this offer is really for the investors who don’t keep across their investments. We suggest now is a good time to blow the cobwebs off your portfolio and make sure you aren’t left holding BOQPC. Let us know and we can get you a firm allocation for rolling over. And if you’re thinking of buying BOQPC now to convert to BOQPD, don’t, you needed to be a registered holder as of the 9th November.

Note: Bank of Queensland CPS will be listed on the ASX and as such the price of the Share’s will be subject to market movements. Investor’s selling on market may receive a price lower (or higher) than the issue price.

Investors looking for an allocation can contact us on 1300 559 869

We encourage you to view our online presentation An Introduction to Fixed Income

Best regards

Sulieman Ravell

Wealth Focus Pty Ltd

Comment: