I thought it was time to update you on my thoughts of the market currently and how I think the risks – and the opportunities – are best managed at this time.

Reading this you may think it’s all doom and gloom but there are always opportunities in every environment. It’s just a case of using the right tools and I’ve tried to explain how this has been reflected in client portfolios towards the end of this article.

The following is an extract from an email we sent to our Personal Advice clients in May who retain us on an ongoing basis. I felt it may also be of benefit to our readers.

The Macro (Overview)

As I have maintained over the last few years, we are in unprecedented investment times. The key risk with investing at this time is that we are still in the middle of an experiment on a grand scale – that is, the extent of quantitative easing (QE) in the global economy – and we don’t have the benefit of a historical playbook on this. In other words, no-one can be sure how the exit from QE will be managed, or play out in the markets.

We’re now into the fifth year of one of the strongest bull markets in history: but one accompanied by one of the weakest recoveries on record. As a result, I still maintain that now, more than ever, we need to be careful in our allocation to risk assets, and I remain suitably cautious.

A combination of this inherent caution; understanding individual managers’ investment biases; picking up on investment arbitrages; and our relationship with brokers on new issues has meant that we have been able to outperform our investment benchmarks with a fraction of the risk, while often holding significant cash allocations.

I recently attended an investment forum on asset allocation where we considered the impact of QE. The question posed to the audience was whether US QE had been successful? If you consider that the aim of QE’s was to reduce bond yields, has this in fact been a successful exercise – or just a very expensive experiment?

The charts used to demonstrate this were the 10-year US Treasury (Government) Bond yields and the S&P 500 Index, over the same period, plotted against (growth in?) US (net/gross?) debt. The point was that QE has had very little effect on government bond yields and that the correlation we’ve seen with US equity markets is probably coincidence.

FYI – Yields falling on bonds = bond prices rising

I made this point on the day (and it’s our house view) that this is not a coincidence, and should not be a surprise.

- The bond market is considerably larger than the equity market and is arguably the smarter investor: therefore, the bond market is more likely to reflect the risks within markets;

- The equity market is much more emotional in its behaviour and is therefore more likely to be impacted by QE;

- QE has always been about restoring faith and ensuring the equity market runs smoothly. Falls in equity market valuations have a real impact on how wealthy retail investors ‘feel,’ and unhappy voters leads to political unrest.

In other words, QE is really a “morale boost” for equity markets. Some cynics might also argue that the larger amounts of savings of politicians and the Federal Reserve members than most people means they also have more to gain from equity markets rising!

Taper Tantrums

We have already seen the markets react and flatten as the US starts tapering its QE.

It does make you wonder, if QE has boosted equity markets so much, what is going to happen once QE ends?

My Concerns going forward

US QE ending

As I’ve highlighted above, what happens around a QE end-game is a concern. The markets already look jittery and this is only the ‘tapering’ stage of QE. The US Fed is still buying $25 billion a month of mortgage bonds and $30 billion a month of government bonds, with the expectation that this buying will reduce at the rate of $10 billion a month over the next few months. I’m concerned that the market has become so reliant on the sugar ‘rush’ of QE that going ‘cold turkey’ later this year could lead to the mother of all hangovers.

Concerned about government debt

My concerns now are that very little has changed. The rises in markets throughout the 1980s, 1990s and early 2000s were fuelled by debt. This came to a head in the Global Financial Crisis, resulting in governments being forced to bail-out the major banks, in effect transferring the debt from the banks to the sovereign balance sheets. And governments have continued to increase their debt.

Unfortunately, this is not limited to the US. Europe, the UK and most economies have been caught up in a knock-on effect, with many opting for some variation of QE within their own economies. Arguably, this is a race to the bottom. I’m not saying anything new here: this is by far the biggest concern the markets have had over the last few years.

The difference now is probably the expectation that we have somehow dodged the bullet and the danger has passed: that is, that government stimulation has generated the green shoots of economic recovery enough to create jobs, keeping the “minions” happy, prompting them to resume spending, further boosting the economy.

Advocates of this argument point to the increase in corporate profitability over the last few years, arguing that companies have reduced their debt levels over the same period citing debt/equity ratios as evidence.

By contrast, its our view that the increase in profitability is being masked by the reduced cost of debt and the reduced debt to equity ratios is likely a result of increasing the equity base with capital raisings.

US corporate debt is at its highest ever, the reason US corporates can boast more cash is that they have raised cash via debt issuance. It does beg the question of what will happen if interest rates rise?

Concerned about growth

This increase in profitability doesn’t surprise me. If you drop your cash rate to zero, the cost of borrowing drops, and corporate profitability increases. But this is a false economy, because what happens when interest rates finally rise again? More to the point, bear in mind that borrowers (homeowners and businesses alike) have become used to incredibly low interest rates. Home-owners who have borrowed at 10% can more readily absorb a one percentage-point increase in rates, but when you’ve borrowed at 3%, this is a considerable increase.

My concern is the market has priced in expected growth in dividends resulting from this stimulation. However, what if we don’t see growth? Furthermore, what happens to growth when governments finally decide to repay their debt and stop distorting the market?

Concerned about inflation

Governments have backed themselves into a corner: their options are either to default on their debt, increase taxes or inflate their way out of trouble. Let’s look at these in turn.

- Defaulting closes the door on further borrowing and significantly increases your current debt repayment, and may even lead to the (hyper) inflation that the government is trying to avoid as capital flows out of the country. For good reason, default is therefore considered the last resort, particularly for larger economies with significant reputational risk (e.g. US, UK).

- Increasing tax is a difficult alternative for politicians, as large tax increases can often lead to civil unrest and a change in government (note the reports we’ve seen in the UK and Greece over the last two to three years).

- Inflation is often perceived as the easiest way out, and that’s why I think it’s one of the biggest risks. By reducing the value of the currency, outstanding debt is inflated away. This is in effect an indirect tax, and is the least repugnant to voters. I suspect the temptation to use this option as a way to reduce debt will become too great and that most governments will opt for inflation as a way out (QE is arguably an attempt to create inflation.) After all, a little inflation is a good thing. If the cost of “stuff” is increasing, then companies are more profitable – which leads to higher employment, which leads to more spending, more saving and more tax revenue. If the population feels wealthier, (even if they have more debt), they are happier and politicians stay in power. To a government under fiscal pressure, it looks like a virtuous circle.

But the problem with inflation is that you have to keep it under control. If inflation rises too quickly, this can become problematic. The cost of production increasing significantly begins to have an impact on profits, which leads to lower employment, which leads to less saving, and less tax revenue – a not-so-virtuous circle. So a careful balance needs to be struck.

Historically, this is a careful balance of using two levers, taxes and interest rates. The issue we now face is that interest rates are so low, significant increases in interest rates are unpalatable. Coupled with the relatively high level of household debt the Developed-world citizens now carry (for example, home loans) means that an increase in interest rates is not going to be easy to swallow. As a result, governments are potentially limiting themselves to one lever to try and control inflation.

This is the biggest conundrum that governments face, and it’s why they are working so hard to manipulate the markets. I expect that we’ll eventually muddle our way through this: we’ll probably see a number of short-term ‘solutions’ appear over the coming years. How this situation eventually plays out, no-one can know, but I wouldn’t be surprised inflation creeps up on us. We think that we’re already seeing signs of this. It’s no secret that food prices are rising significantly, workers’ incomes in emerging markets have increased and unions in the US are demanding higher minimum wages: these are the harbingers of inflation.

Concerned about the banks

I’m concerned about our banking sector. Our banks are trading on price/earnings (P/E) multiples of 15 times earnings and above, indicating an expectation of growth. In contrast, offshore banks (many of which now have significant government ownership) are trading on P/E ratios of three to five times earnings. Without spending too much time on this (you can read more in the attached report from Watermark), our banks have been forced to hold more capital against their lending, with the introduction of 8-9% Tier 1 Capital reserves versus 5-6% pre GFC, and to improve their lending. This must impact on their profitability – and potentially even lead to reducing dividends.

Australian investors love the Big 4 banks and seem to think they are indestructible: the banking sector now makes up around 60% of the S&P/ASX 20, but hiccups and dividend cuts could well see us fall out of love with banking shares.

That aside, our view is that we shall eventually see the banks increasing their lending in the SME space, and this could create opportunity in the small to mid-cap stocks.

Concerned about value

Our valuation methodology means we are always considering whether it’s worth investing in an asset class over the next ten years, versus the relatively riskfree rate of return of Australian government bonds (currently about 3.93% a year).

Two years ago, our indicators were showing many markets as ‘cheap.’ Asset classes across the board no longer look cheap: the area that looks to offer the most value is the emerging markets, but this asset class carries an added risk of “hot money,” which increases the volatility of investing in equities. Since most of our clients are close to, or at retirement, it’s generally a risk not worth taking on, if for no reason other than avoiding giving our clients heart attacks.

The easy money has gone

Three years ago, I was readily finding opportunities like Macquarie Winton Global Opportunities Fund, a then-listed investment company that invested into a Winton managed futures strategy. The fund often traded on the market at a discount to Net Tangible Assets (NTA), of up to 8%; yet units could be redeemed at NTA on a quarterly basis. Since Winton (which was delisted in late 2012) was a fund we were allocating to anyway, the arbitrage just allowed us to pick up 32% a year, in addition to the gain or loss of the underlying in a fund in which we were going to invest anyway.

Many of the listed investment companies (LICs) we use within portfolios were trading at discounts of 10-20%: these are now trading at NTA or a premiums so we’ve benefited from both the underlying rise in the investments and the move in NTA from discount to premium.

Hybrids and bond yields are tight

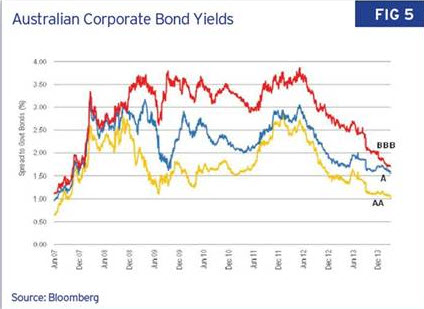

Over the last few years, we’ve seen the spread on fixed income and hybrids reduce significantly: we are now approaching the level of spreads seen prior to the GFC.

We are now seeing many of the hybrids trading at around 5% a year yield to maturity.

CBAPA, which we have regularly used within portfolios (due to mature in October this year) is trading at an annualised yield to maturity of 4%. If the security is redeemed earlier, in August, the annualised return is only 3% a year. Given that cash rates are higher than 3%, this is clearly not good value. The price indicates that investors are either unaware that CBAPA is poor value, or buying it to ensure they gain access a potential new CBA issue.

By contrast, two years ago we were buying the IAG convertible preference share (IAGPA) as it approached maturity, to pick up a 22% a year return in just a a few weeks of holding the security.

We are seeing this across the board in hybrids: yields on bank hybrids have moved from around 7.5%pa in May 2012 to 5%pa that we are now seeing. In many cases investors, we don’t think that investors are being adequately rewarded for the risk of investing in these securities.

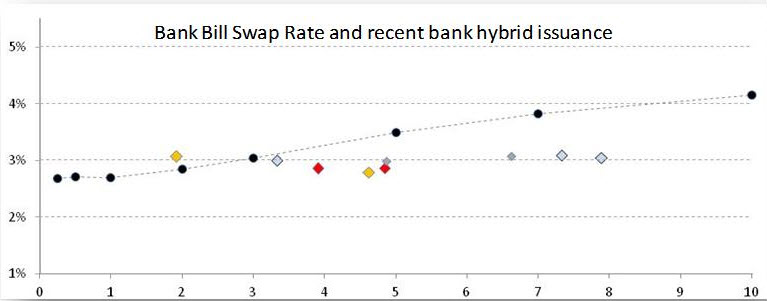

This is also distorting the yield curve. You would expect that a longer term to maturity commands a higher return, yet retail investors are just happy to lock in the same margin regardless of term. (see Bank Bill Swap and recent bank hybrid chart)

Residential Property

We are not property experts but it’s no secret the Australian property market is hot right now. This is something we’re also seeing overseas. Property spruikers are likely to tell you that property doubles in value every ten years, and negative gearing is a benefit because you get a tax deduction.

I use a common-sense approach in considering this.

If I get a tax deduction, this is because I am losing money, and the reason I am happy to lose money on the income is because I expect to benefit from a capital gain.

I find myself questioning where the capital gain is likely to come from.

Now, rental yields are about 3%, the cost of borrowing is around 5% and interest rates are at all-time lows. In the super-low (0%-0.5%) interest rate environments like the US and UK, lenders are offering honeymoon rates at about 3.5%, with standard rates of 4-5%. So even with a higher RBA rate, home loan rates look close to the bottom of what we can expect.

It’s been shown that the biggest driver of property gains is how much the banks are willing to lend. With loan-to-value ratios (LVRs) of 90-95%, there isn’t much room to increase this. If interest rates finally go up, I can’t see the room for capital gains, so property looks like an excellent way of getting tax deductions – that is, losing money.

This also feeds into my concern over the banks right now

My other concern is that many of these are well-publicised, and are likely to have already been factored in by the market. As a result, this will probably mean we’ll see the market continue to run until a surprise event shocks the market into a correction.

We are not there yet, my guess is probably another 4-5 months, but these are my considerations in structuring portfolios and the old phrase “sell in May and go away, come back on labor day” (it’s a US phrase) may be well suited.

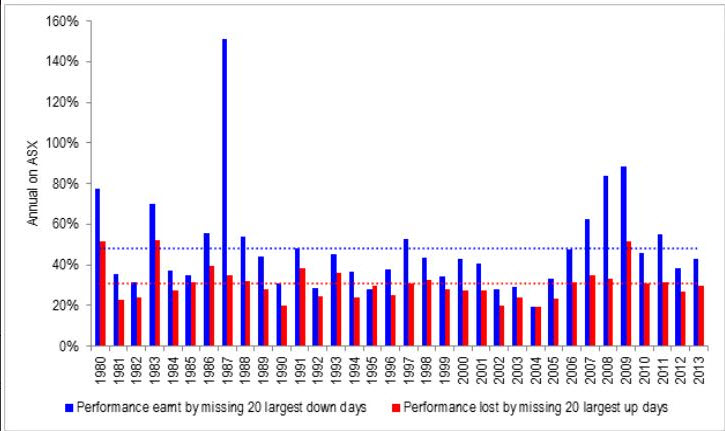

I don’t believe investing in index funds is suited to this environment. I often hear the phrase “time in the market not timing the market” yet an analysis of performance and the effect of missing the 20 best days versus avoiding the 20 worst days each year shows that there is more to gain in being cautious and my view is a good stock picking manager is likely to provide investors with the best risk adjusted returns in this environment.

So where do we see value right now and how are we reflecting this within client portfolios?

Our client portfolios are a mixture of LICs, managed funds, exchange-traded funds (ETFs) and some directly held hybrids.

Overall, I remain quite cautious in my outlook: I think the “unknowns” are likely to throw up opportunity, and holding higher levels of cash will allow us to benefit from that.

The issue is that there are fewer places to hide; and just because something looks fully priced/expensive doesn’t mean it’s going to get cheaper. We’re gradually moving portfolios to a more defensive position, and we are likely to be holding higher levels of cash.

Although this may be to our detriment if the market runs strongly, our higher cash positions have allowed us to benefit from the short term investment opportunities that come our way.

Our clients who are typically retirees or approaching retirement, don’t have the luxury of riding out large falls in capital values and the majority of our readers are in a similar position.

Complacent markets are a dangerous thing as a shock event is likely to have a much larger impact on asset prices.

Investment managers

We have always held the view that managers hold a natural bias in their experience and expertise, and its our view that a good financial adviser understands the strengths and weaknesses of each manager, accessing those most suited to the anticipated environment.

In this market, its not just about the returns but the risk being taken to achieve this.

In terms of the holdings I’m recommending, this year has seen me gradually allocating to managers I feel are more defensive by nature and reducing exposure to the banks.

Listed Investment Companies

Although this is less of a problem for long term investment, we are conscious that despite the underlying value, LICs can trade at bigger discounts than they are at currently. Over the last 18 months, we have benefited from LICs moving from trading at large discounts now trading at premiums, and we have gradually been trimming our holdings.

I hope that helps provide some insight into how we think about portfolios.

I should add that we are financial advisers first and foremost but we have found risk management and portfolio recommendations are key differentiators for our advice clients.

Comment: