A planner’s perspective

|

Hybrid SecuritiesAs income investors wait patiently for a return to normal cash rates, the hybrid security market is offering attractive returns which have not been seen for some time |

|

Hybrids are a $24 billion market on the ASX with over 60% assigned an ‘A’ credit rating. With the banks responsible for 55% of the issues, investments in these securities can offer investors an attractive income stream.

Greater Returns

The GFC has actually strengthened the case for investing in hybrids as interest margins have increased resulting in higher returns for an investor. CBA was able to issue CBAPB at a margin of 1.05% over the 90 day BBSW in 2007. The uncertainty caused by the GFC meant that the margin reached a high of 3.1% for CBA when it issued CBAPA in 2009.

With increased security

In addition to this, companies have raised additional capital which provides greater security to a hybrid investor at the expense of the returns on equity for ordinary shareholders.

Portfolio Construction

When we construct portfolios for our clients, we invest in companies which are frequent issuers of hybrid securities. In order to protect their reputation and ensure that there is a market for their future hybrid issues, these companies seek to protect their reputation in credit markets by paying out existing hybrid issues upon maturity rather than rolling them over. This provides the market with greater confidence to invest in their hybrid securities as there is a realistic expectation that the face value of the hybrid security will be received upon maturity.

We anticipate more hybrids to be issued over the coming months

With an increase in demand for income returns, we would not be surprised to see more hybrid issues over the coming months. In light of the current climate and the anticipated increase in interest rates, we feel investors would do well to consider adding this asset class to their overall portfolio.

What are Hybrids?

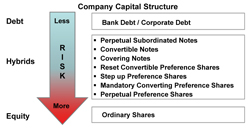

A ‘hybrid’ security is best described as a loan from an investor to a company in return for a series of interest payments and can offer fixed or floating interest rates. Hybrids can offer a fixed maturity at which point the face value of the loan is paid back to the investor or the loans can converted in to shares in the company at a nominal discount. Other hybrids are perpetual in nature. Hybrids are sought after as a source of income as they contain caveats ensuring investors are paid their interest in preference to ordinary shareholders receiving dividends. This has been evident through-out the GFC where even our big 4 banks cut their dividends but hybrid investors continued to receive the full value of their interest payments.

Hybrid securities appeal to investors as they are listed on the ASX providing daily liquidity prior to maturity/conversion. Being listed also provides for equity like properties as high demand for a particular security can see it trading above its face value and conversely, if there is a concern about the credit risk of a company, the share price can trade at a discount to the face value. Factors such as changing interest rates and the perceived credit-worthiness of a company can move the price of the security away from its face value. If held to maturity/conversion, a hybrid will typically return its face value to the investor. In terms of security, hybrids sit between the surety of debt and the uncertainty of equity.

All views expressed within this article are NW Advice Pty Limited’s.

Disclaimer: The advice provided in this article is general in nature and it does not take into account your needs, objectives or financial situation. You should always take these matters into consideration before making an investment decision.

NW Advice is an independently operated, non-aligned financial planning practice offering fee for service advice. Any opinion and recommendation within this newsletter by NW Advice are independent of our own views and should not in any way be construed as personal advice.

Comment: