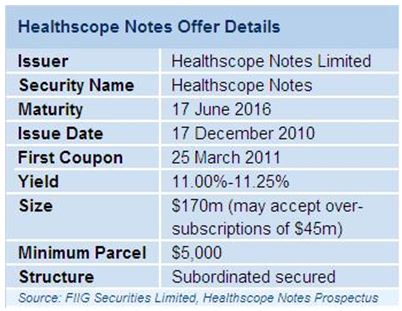

Healthscope is the latest company to enter the retail bond market with a five and a half year bond (Healthscope Notes).

Healthscope, a private healthcare service provider and operator of private hospitals and pathology labs around Australia, Malaysia, Singapore and New Zealand, was privatised by the Carlyle Group and TPG in October of this year. They are looking to raise between $170m and $215m to refinance the bridging loan facility utilised during the acquisition.

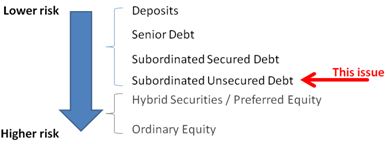

Overall, Healthscope has $1.2 billion in Senior debt drawn down which ranks ahead of the Healthscope Notes issue. The Carlyle Group and TPG have contributed equity and loans of $1.5 billion which rank behind the Healthscope notes in terms of security.

The Healthscope notes will offer a fixed rate yield of at 11%-11.25% (minimum of 11%). The exact pricing is to be set at the bookbuild to be finalised on the 24th November. The notes are expected to be tradable on the ASX.

Equity like returns

This Notes issue highlights the increased cost of funding post GFC as investors have re-priced risk in the marketplace. These Notes provide investors with the opportunity to receive equity like returns with enhanced security.

The higher returns available on debt are a function of where we are in the credit cycle as well as the increasingly punitive regulation placed on banks globally.

We have been proponents of investing in credit and corporate bonds for the past two years and our stance has been justified by significant outperformance of this asset class over equity markets during this time.

Since the GFC, companies have raised capital, reduced their leverage and retained profits which enhances the security of a bond investor (whilst lowering the return on equity to shareholders).

A classic example of the advantages of investing in high yielding bonds was provided by the retail bond issues of Tabcorp and AMP last year. These securities were issued at initial spreads of 4.25% and 4.75% over BBSW last year when credit markets were in turmoil. As investors have become more comfortable with those deals and credit spreads have contracted, the prices of these securities have increased substantially above their issue prices.

High income, but not without risk

Private equity companies generally generate their profits from improving the underlying business as well as increasing the leverage. This increases their return on equity. Therefore, investors should not expect an 11% return from a fixed income security without some risk.

We note that in the event of insolvency, the senior secured banking facility of just over $1.2bn (more than 90% of the group’s assets) ranks above Healthscope Notes. The Healthscope Notes will have preference over the unsecured creditors of the company, which notably, includes the Carlyle Group and TPG.

This high level of “skin in the game” from the private equity consortium is reassuring. In the event that Healthscope breaches its debt covenants or is faced with other financial difficulties, it is reasonable to believe that private equity investors are more likely to inject further capital into the business rather than just writing off their loss.

Always count your fingers

Investors must always be cautious when dealing with private equity consortiums as their self-interest is always the driver of their actions (just ask the ATO in relation to the Myer sale by TPG!). Importantly, the Carlyle Group and TPG have agreed to constraints on issuing new debt and they have also included penalty interest rates in the event that they defer any interest payments.

Senior Debt vs Healthscope Notes

The Senior Debt, which was provided by institutions, was priced very close to the Notes issue, despite the greater security offered to them. Whilst this is an area for concern, we are conscious of the fact that this is a retail offering with smaller minimum investments required and liquidity available through the share market. Both of these factors provide the retail investor with tangible compensation.

Summary

We believe that the Healthscope Notes offer an attractive fixed rate of return, even in an increasing interest rate environment and are worthy of a position in your portfolio. It is important to note that they are not without risk. Happy investing!

Best regards

Sulieman Ravell

Wealth Focus Pty Ltd

Comment: