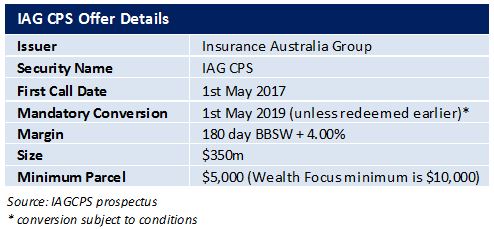

IAG has just announced the launch of a new income offer: IAG CPS.The first round of access is through a broker firm allocation, prior to shareholder offer and listing in May.

IAG CPS will pay a half yearly coupon of 4.00% over the 180 day bank bill swap rate (BBSW), 4.45% as of 23rd March, with an initial indicative rate of 8.45%pa. (The first semi- annual price is due to be set on date of issue) and are expected to redeem 1st May 2017*. The shares will be tradable on the ASX.

This issue will be used primarily to repay of the current listed RPS (IAGPA).

It is expected that the issue will be repaid at the first opportunity in May 2017 with a mandatory conversion in 2019 (subject to mandatory conditions not being breached).

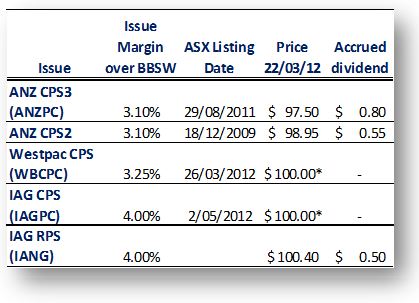

Comparitive Securities

The structure of this issue is similar to the recent Westpac CPS (WBCPC) and ANZ CPS3 (ANZPC) issues. All three structures offer a margin over the 180 day BBSW and contain a conversion clause to ordinary shares in the event that the companies get themselves into real strife.

IAGPC’s feature is called a Non-Viability clause and in the event that APRA deems IAG would become non-viable in the absence of a capital injection, IAG CPS would convert to ordinary shares.

Comparable IAG Securities

Of IAG’s current listed securities, parallels can also be drawn with IANG (IAG Reset Exchangeable Security, which is also listed at a margin of 4.00% over the BBSW, (albeit the 90 day BBSW).

A quick analysis

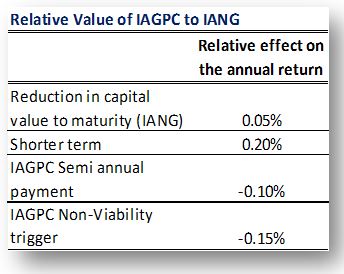

At time of writing, IANG currently trades at $100.90 including a 50c accrued dividend (ex. div on 1st March 2012), reducing the effective return to maturity by 0.05%pa.

However, IAGPC is up to 2.5 years shorter than IANG converted at the first optional exchange date and therefore should have a reduced risk associated with it. Looking at comparable Bank Bill Swaps over this period, this indicates a premium of 0.2%pa should be expected for this extended term.

The time value of paying semi-annual versus quarterly payments reduces the effective interest rate by approximately 0.1%pa.

The additional risk of the Non-Viability clause is difficult to assess since there are only ANZPC and WBCPC comparables (WBCPC has yet to list).

Looking at the trading history of ANZ CPS3 (ANZPC), which contains a similar clause, relative to ANZ CPS2 (ANZPA) which does not, there is typically a trading margin of 0.5%-1.0% for this risk. This equates to an additional margin requirement of 0.1%-0.2%pa.

Key Points

- Indicative floating yield of 8.45%pa (fully franked) provides investors the opportunity to take advantage of historically high hybrid margins.

- Option to redeem at year 5 with mandatory conversion at year 7 – IAG has the option to convert in May 2017 or on any subsequent dividend payment date.

- Financial Strength – IAGPC provides investors exposure to one of the largest companies listed on the ASX and a market cap of over $15.5bn.

- Automatic conversion under a Non-Viability Trigger Event – In the event that APRA deems IAG would be Non-Viable, IAG CPS would convert to Ordinary Shares

- Existing IAGPA Shareholders (as of the 16th March 2012) will be able to convert their holdings into IAGPC and receive a pro rata special dividend to the 1st May 2012.

Our View

We don’t think IAG aren’t giving anything away on this issue. We note that IANG had performed very strongly in the lead up to Christmas as investors looked for a high grade alternative to diversify away from the banks.

We expect that the recent flood of new hybrid issues will hurt IAG’s ability to issue much more than the $350 Million they asked for. Indeed it is rumoured that they had initially looked to launch this issue at a lower margin but were forced to increase this to compensate for the recent falls in prices due to new issues.

Overall, we feel this issue is fairly priced at this stage. The higher margin of 4.00%pa over the 180 day BBSW, is a reasonable margin when considered next to ANZPC (3.10%) and WBCPC (3.25%) and we expect that we will see an increase in hybrid prices again once the downward pressure caused by new issues has subsided.

Existing investors in IAGPA would do well to consider taking up the early entitlement to cash in at $100 face value and a pro-rata dividend of $2.1286 (fully franked) on 1st May 2012 and accrue dividends at the higher rate.

Note: IAG CPS will be listed on the ASX and as such the price of the Share’s will be subject to market movements. Investor’s selling on market may receive a price lower (or higher) than the issue price.

Best regards

Sulieman Ravell

Wealth Focus Pty Ltd

Comment: