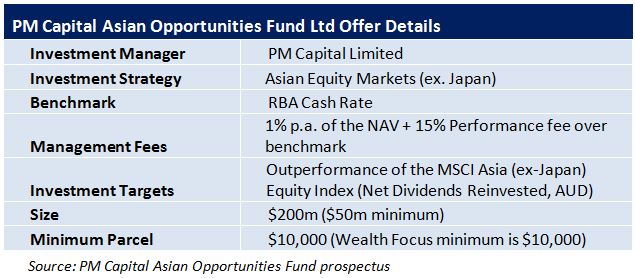

PM Capital has announced the launch of a new Listed Investment Company: PM Capital Asian Opportunities Fund (PAF).The first round of access is through a broker firm allocation, prior to the shareholder & general offer and listing in May.

The Shares aim to provide investors with a return in excess of the MSCI Asian (ex Japan) Equity Index. The Shares will be tradable on the ASX.

PM Capital

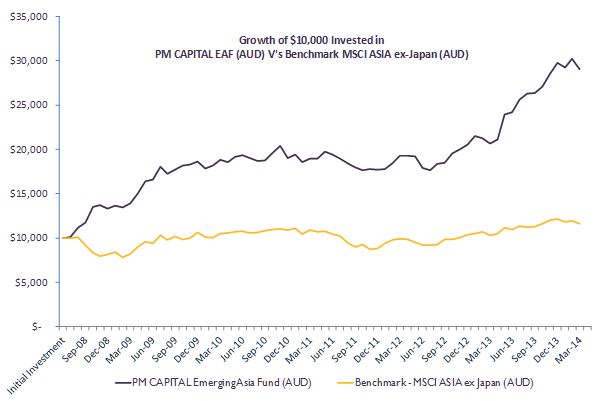

PM Capital currently manages a successful unlisted managed fund, PM Capital Emerging Asia Fund which operates with a similar investment mandate and we have referenced this investment in our analysis of the offer. Since the management style and team are so similar, we feel investors would do well to familiarise themselves with the Emerging Asia Fund in making a decision on whether to invest in PM Capital Asian Opportunities Fund.

The success of BT in the 1990’s was credited to Kerr Nielsen of Platinum Asset Management fame. Working with Kerr was Paul Moore who went on to establish PM Capital. Justin Braitling was also a graduate of this class and he went on to establish Watermark. All three managers have demonstrated their capabilities through various investment cycles and we applaud them for their stringent focus on protecting their client’s wealth as much as they focus on growing it. The power of compounding should be revered by the investment community but sadly it does not receive the respect that it deserves.

Demand for Listed Investment Companies (LICs)

We expect to see continuing demand for Listed Investment Companies over the next year or so and would not be surprised to see more issues coming to market. Retail investors and advisers have shown a renewed interest for listed vehicles as they do have certain advantages over unlisted investment vehicles, namely the ability to take long term positions in targeted investments without fear of having to redeem as investors sell shares rather than redeem cash if they want to sell; the removal of having to manage cash flow from daily applications/redemptions; the ability to issue options and control of tax consequences to the end investor through matching dividends to available franking credits.

We are also of the view that the Future of Financial Advice reforms which have banned various commissions has led advisers 0to consider LICs and we are less likely to see the larger discounts to Net Tangible Assets (NTA) that we have seen in the past.

PM Capital Asian Opportunities Fund Limited

We have identified a confluence of factors which are aligning for an investment in the Asian Opportunities Fund:

- Fixed asset investment in Asia is slowing which means less demand for our commodities and reduces the ability for Australian investors to capture the next leg of the urbanisation of 4 billion consumers via the Australian equity market

- The Australian dollar is perceived by many to be elevated due to the manipulation of interest rates by the Federal Reserve which is likely to unwind as the Fed continues with its tapering program and looks to raise interest rates

- The Chinese equity market has not participated in the exuberance of western equity markets and is basically unchanged since 2008 and offering selective opportunities for investment

- The Chinese Government is continuing to reform their capital markets which will foster more efficient capital markets with the latest developments being;

o Allowing financial institutions to issue preference shares to recapitalise their stretched balance sheets which will provide more capital for growth

o Slowly liberalising Chinese equity markets through the Shanghai-Hong Kong Connect program by allowing selective investment from Hong Kong brokers in to China and the reverse

An analysis of PM Capital’s Emerging Asia Fund investment performance since launch in 2008 versus the MSCI Asia (ex Japan) demonstrates quality of their stock picking to date.

Past performance is not a guide to future performance.

We should note that the existing unlisted fund is long only and it’s our view that the additional flexibility of the new mandate which permits shorting should help in reducing risk and increasing returns.

Key Features

- Limited Offer – The offer is to raise up to $200 Million, with a minimum of $50 Million. The shares will be traded on the ASX.

- Long Short Strategy – The fund’s mandate is principally focused on long investing but will permit shorting up to 30% of the portfolio value to primarily offset sector bias in the portfolio.

- Free option – Each investor will receive a free option for each share subscribed to in the IPO. In this case, there is a longer expiry than we have seen on recent issues and should result in the option trading well upon listing, representing the greater time value of the option.

- Targeted return –The company is aiming to outperform the MSCI Asia (ex Japan) Equity Index (Net Dividends Reinvested)

- Dividends –This strategy is primarily targeting growth but the expectation is that the fund will pay fully franked dividends subject to the availability of franking credits.

What we like

- Investment Pedigree – PM Capital is yet another manager to continue their success post BT Investment of the 1990’s. If you believe in strong bloodlines with investment managers, and like the style of other long short managers such as Platinum and Australian Leaders Fund, you would do well to consider this fund.

- Free option– Each investor will receive a free option for each share subscribed to in the IPO. Exercisable at $1, we value the option at between 8c-10c.

- Long Short Strategy– We continue to have the view that markets are likely to remain choppy. Since Long Short managers are able to benefit from their shorts in a falling market, we feel they offer an advantage over their long only counterparts.

- PM’s relatively cautious approach– Looking at PM Capital’s allocation of the funds raised for the Global Opportunities Fund in December, it’s quite clear they are in no rush to invest if they don’t think there is value. In this market, it’s our view it pays to be cautious and we feel PM’s contrarian style to market investing pays in the longer term and helps reduce investment risk.

- Investing in Asia via Western economies – PM Capital’s mandate also allows them to invest in stocks listed in other markets provided their income is primarily sourced from Asian economies. This is a prudent strategy which provides the flexibility for the manager to only invest in compelling companies.

What we don’t like

- Listed Investment Companies often trade at a discount to NTA – Although we feel this is likely to become less of an issue from the 1st July when commissions are banned and financial planners are therefore more likely to consider LICs. Better performing and more established managers are more likely to trade at a premium and vice versa. Platinum Capital, Magellan Flagship Fund and PM Capital Global Opportunities Fund all currently trade at a premium to their underlying asset value.

Our view

Overall we believe long short strategies are suited to the current economic environment. We are also firm believers in the investment style that we’ve seen come out of the BT under Kerr Nielson. This has led us invest in Platinum and Australian Leaders Fund and PM Capital is another manager investing in the same vein.

Investors looking for Asian exposure would do well to consider this fund. In current market conditions, and looking at other international LICs (generally trading at a premium), we feel it unlikely that the shares will trade at a meaningful discount and our concern is offset with the free option for initial subscribers.

Note: PM Capital Asian Opportunities Fund will be listed on the ASX and as such the price will be subject to market movements. Investor’s selling on market may receive a price lower (or higher) than the issue price.

Investors looking for an allocation can contact us on 1300 559 869

Best regards

Sulieman Ravell

Wealth Focus Pty Ltd

Comment: