A-REITS: Despair or a new dawn?

The Australian Real Estate Investment Trust (A-REIT) index is down 59.6% on a rolling 12 month basis and with intra-day swings in excess of 10%, the conservative landlord image is not washing with spooked investors. As tracked by the SPDR exchange traded fund, SLF, the trailing yield is 16.6%. Unfortunately trailing yields are not going to be accurate in the short term as property trusts are in the midst of raising capital, reducing distributions in line with earnings and deleveraging.

Current broker research suggests that distributions will be cut by 12% from December 2007 through to June 2009. Playing it safe, you can cut a further 26% due to the significant capital raisings and arrive at a distribution of 38% lower than June 2007.

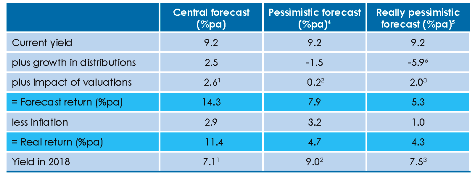

At the current index level of 980, this translates to an earnings yield of 9.2%, an extremely healthy yield when cash and inflation rates are trending down. It is important to remember that approximately 85% of property trust earnings come from the sedate role of collecting rents.

Given that the economy is slowing, there may be a short term spike in vacancy rates however the long term fundamentals remain in place.

So the question is how quickly can A-REITs grow their earnings?

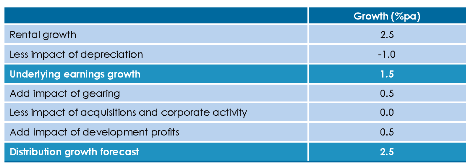

Historical analysis suggests that due to the cost of depreciation, growth should be just below inflation. With the addition of prudent gearing and development profits, growth in distributions are likely to resemble this:

Forecast of distribution growth in A-REITs

1. A yield of 7.1% in 2018 contributes to a 2.6%pa rise in returns over 10 years.

2. A yield of 9.0% in 2018 contributes to a 0.2%pa increase in returns over 10 years.

3. A yield of 7.5% in 2018 contributes to a 2.0% rise returns over 10 years.

4. 1 in 20 real worst-case return

5. 1 in 50 real worst-case return.

6. A further 45% fall in distributions.

At the current index level, even under a really pessimistic scenario of a 45% drop in distributions, the real return from property trusts is healthy under the assumption that inflation will also drop in such a scenario.

We are currently adding to A-REIT holdings for our clients. Investors would do well to consider doing the same

The market may sell off more but the yield pays you to hold them in the short term whilst waiting for a correction to the upside.

A further strategy that you can consider is to sell a put option over SLF, in the anticipation that you will purchase the shares and pick up a healthy premium (yielding circa 38.43% pa annualised for a one month exposure) due to the current volatility in the market.

Comment: