Not just another BRIC in the wall

Emerging markets continue to be the fastest growing economies. We examine Macquarie’s joint venture into the BRIC economies and how this can benefit your portfolio.

The emerging markets is not a recent story by any means, the early to mid 90’s the South America and in particular Mexico were amongst the economies that were marketed most heavily. However, as we’ve already mentioned within this issue, the advances in technology and telecommunications means that globalisation is now becoming a reality.

The chances are that you already have an active role in the globalised economy. You only need to call your telephone or utilities provider to speak to a customer services rep in India or the Middle East, whether you are aware of it or not is another matter. Some companies go as far as training their staff to speak with a localised accent and keep them updated with local weather reports and TV shows to add that personal touch. Whether you think it’s a good thing or not, one things for sure, its here to stay.

We have become a throw away society where we expect to be able to jog down to the shop and immediately buy anything we want. Services like Ebay have been built around our need to get rid of the “junk” that we only bought last year, to make room for our latest “essential items”.

Our emphasis on quality has changed too, we often opt for cheaper less durable goods on the basis that we’re going to want a new one in a year or so anyway. In fact, it’s often cheaper to buy a new product than get the one you already have fixed. We have become the super consumer.

Emerging economies have become the ultimate supplier, offering goods and services at a fraction of the cost that can be sourced locally and for a fraction more, can include the quality (if you want it). In turn, these economies are benefiting from huge increases in household income, families additional wealth means that they in turn are consuming their own local goods. The need for better roads and rail systems to continue to fuel this growth means that governments are committing trillions of dollars towards infrastructure, which in turn is benefiting those involved in the building industry and commodities such as oil, gas, iron etc.

Emerging economies have become the ultimate supplier, offering goods and services at a fraction of the cost that can be sourced locally and for a fraction more, can include the quality (if you want it). In turn, these economies are benefiting from huge increases in household income, families additional wealth means that they in turn are consuming their own local goods. The need for better roads and rail systems to continue to fuel this growth means that governments are committing trillions of dollars towards infrastructure, which in turn is benefiting those involved in the building industry and commodities such as oil, gas, iron etc.

The BRIC economies, short for Brazil, Russia, India and China, are considered to be at the forefront of the economic revolution of the emerging markets.

Indeed, it is estimated that 1 trillion US dollars is going to be spent on infrastructure within emerging markets over the next 3 years, 71% of which is in the BRIC economies.

With Gross Domestic Product (GDP) growth of over 10% in 2007, versus 2.6% (advanced economies), and a projected 9.4% growth in GDP for 2008 (2.2% advanced economies), in our view BRIC economies offer a greater opportunity for growth over the coming year.

Macquarie’s joint venture – the Globalis BRIC fund – An opportunity not to be missed

Our view is that the Globalis BRIC fund offers an excellent opportunity to invest in the BRIC economies and emerging markets.

Our view is that the Globalis BRIC fund offers an excellent opportunity to invest in the BRIC economies and emerging markets.

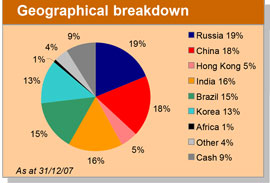

Unlike some of the other emerging markets funds available, their exposure is not just limited to these four economies and is not just a vanilla index fund, tracking the BRIC economies up and down. Globalis’s mandate allows them to invest where they feel there is opportunity in emerging markets outside of the four BRIC economies. Indeed, the current asset allocation shows that 18% of the fund is currently invested outside of BRIC, giving investors further diversification.

Active Management

Active Management

In our view the management teams 49 years emerging market investment experience of differing market conditions and investment cycles should give them the edge in identifying market opportunities. Our view of the emerging markets sector is that whilst it be an opportune time to invest in the BRIC economies, by nature, these markets are relatively volatile and due to the illiquidity of these markets some managers may find themselves unable to trade in or out of positions quickly enough. We therefore feel it beneficial that Globalis actively manages the fund using index funds and derivatives as investment vehicles rather than holding individual stocks. This allows them to proactively move in and out of the markets and even capitalise on volatility.

Access to the Globalis BRIC Fund

Access to Globalis is limited, this is a wholesale investment fund and as such direct investment is limited to investments in excess of $500k. As a result we have hooked up with Wealtrac Wrap to provide access to the Globalis fund from 1.96% pa to 2.73% pa depending on fund size.

Hedged or Unhedged

Globalis BRIC fund is available in plain vanilla, as an unhedged fund (traded from the US and based in US dollars) or you can opt to invest in the hedged fund which has a small element investing in derivatives to hedge /insure against currency risk of the US dollar falling in value against the Aussie dollar. We would suggest, if you feel as we, do that the US dollar is likely to continue to fall in value or simply that you want one less thing to worry about, then the hedged fund is likely to be a better option for investment.

HOW TO APPLY

Download online: Download a copy of the PDS direct from our website www.fundsfocus.com.au/latestoffers

By post: You can request to a hard copy of the Wealthtrac PDS by calling us on 1300 55 98 69 or request a hard copy using our online form

Comment: