Prime Value Growth Fund

(No Entry or Adviser Fees) |

Our March newsletter highlighted our concerns of Government debt problems impacting equity markets and that investors should become more selective in the managers they choose over the coming year.In light of the issues in Europe, we highlighted a preference for Australian Equities, most notably boutique fund managers. We highlighted Prime Value as one of our featured funds as they have a proven history of outperforming the larger Australian equity managers with a lower volatility (risk).Wealth Focus is pleased to offer investors looking to re-balance their portfolio or re-enter the markets at these lower levels access to the Prime Value Growth and Imputation Funds with a 100% rebate on the entry fee. Our March newsletter highlighted our concerns of Government debt problems impacting equity markets and that investors should become more selective in the managers they choose over the coming year.In light of the issues in Europe, we highlighted a preference for Australian Equities, most notably boutique fund managers. We highlighted Prime Value as one of our featured funds as they have a proven history of outperforming the larger Australian equity managers with a lower volatility (risk).Wealth Focus is pleased to offer investors looking to re-balance their portfolio or re-enter the markets at these lower levels access to the Prime Value Growth and Imputation Funds with a 100% rebate on the entry fee.

Quick Links

– Key Facts (Growth Fund)

– Download/Order a PDS

– Feature on Boutique Fund Managers

Alternatively investors can call us on 1300 559 869 to request a PDS. |

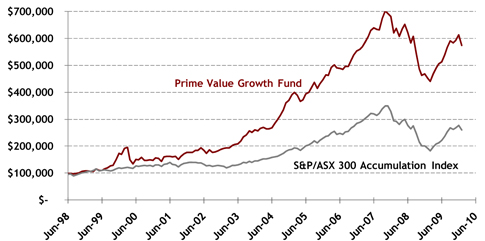

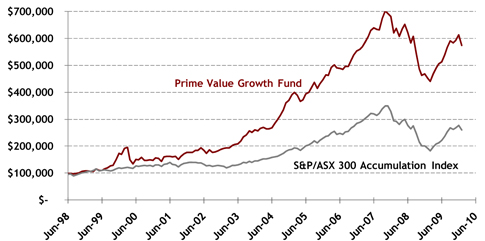

Past Performance (31/01/2010^)

|

| ^ Past performance is not a reliable indicator of future performance |

|

|

|

|

|

Key features

- No Adviser Fees – Our commitment to provide the lowest cost for the DIY investors means that readers are able to access this investment with no entry fee and no adviser service fees.

- Higher Returns with Lower Risk – Relative to larger Australian Equity Funds, the Prime Value Growth Fund has outperformed 16 out of the top 20 largest Aussie Equity funds over the last 5 years and yet has managed to maintain a lower level of volatility (risk measure) than 19 out of the 20 largest funds (as of the 28th Feb 2010).

- Flexible Investment Strategy – One of Prime Value’s key strengths has been their ability to change their strategy with the times. Initially benefiting from smaller caps the fund has moved towards resources then heavily in cash through the GFC with a more recent move towards larger cap stocks.

- Alignment of Interest – Highlighting a commitment to the investment philosophy, Prime Value’s key staff held 4% of the Fund as at 28 February 2010.

- Minimum Investment – $20,000 (through Wealth Focus)

|

|

|

| Find out moreIf you would like further information on Prime Value Growth Fund, please click on the links below:

Alternatively, if you wish to obtain hard copies or discuss this investment further, please call us on 1300 559 869. |

|

|

|

|

|

|

Comment: