|

The Insider

A tale of poor advice on one of Australia's best superannuation funds |

|

By Sulieman Ravell - 2nd February 2014

|

|

|

The Insider The Insider

Defined Benefits (DB) superannuation schemes are few and far between in Australia and offer a rare commodity in financial services: a guarantee which is paid for by the scheme and not the member.

In this article, we assess a DB scheme we consider to be “golden handcuffs” for anyone lucky enough to be a member of it – and how Holden employees can take advantage of this.

Each scheme differs, but DB schemes generally offer a guarantee of either a lump sum or income at retirement, depending on how many years the member has contributed to the fund. The underlying fund is invested by the trustees, but the returns typically dictate whether the employer needs to top up or (in good years) reduce their contributions, to ensure there’s enough money in the pot for the guarantee.

When these schemes were launched in the 1970s and 1980s, long-term market returns were in the range of 15-20% a year, life expectancy was lower and high bond yields meant the overall cost of providing these guarantees was negligible.

That tide has turned, and employers can now find themselves trying to fill a bottomless pit to honour the promises explicit in DB schemes. Most of these schemes have now closed down or are no longer allowing new employees to join. One such scheme is the Holden Defined Benefit Superannuation Fund.

In light of last year’s announcement that Holden intends to close down its manufacturing in Australia, we thought we would publish our view of the company’s DB scheme. I certainly provides an interesting case study.

Wealth Focus was engaged to advise employees on their superannuation in 2012 and quite simply, we were shocked that so few had taken Holden up on an offer that we consider “golden handcuffs”.

We could not work out whether this was just a general lack of understanding or negligence on the part of those advising the employees. We felt an explanation of the Holden scheme’s benefits would help employees to take advantage of this anomaly in the Australian superannuation industry. |

|

Holden Defined Benefit Pension Scheme Holden Defined Benefit Pension Scheme

There are slight variations of the Holden Defined Benefit Scheme based on the type of employee (typically senior employees or ordinary workers) but the primary schemes operate in a similar fashion. They are “defined benefit” schemes in that they promise a certain income based on the member’s final salary and years of paying into the scheme and the amount paid. This income is paid for as long as the member lives.

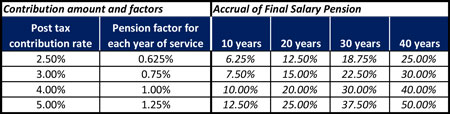

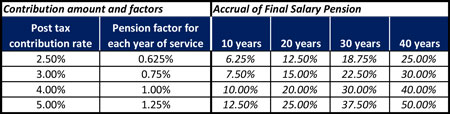

Someone paying 2.5% into the scheme will receive 0.625% of their final salary for life at retirement at age 65. Ie 40 years of contributions would result in 40 x 0.625% = 25% of their final salary for life, albeit non-indexed.

The senior employees’ scheme is based on a 5% contribution rate and naturally a little better in accrual rate (pension factor) and is based on a 5% accrual rate.

The normal retirement date is age 65, but employees can opt to receive a pension income from age 55, subject to a reduction factor for each year of early retirement. In effect, the reduction factor reflects both the extra years for which the pension is now expected to be paid, and the years that the employee is no longer contributing to the scheme. At first glance, it can seem excessive, but is generally fair to all involved.

Overall, we think the benefit in both circumstances is massively attractive – and I can’t underestimate the word “massively".

|

|

|

|

What’s so attractive about Defined Benefit Pension Schemes?

The first thing to understand with Defined Benefit schemes is that the promise to provide an income for life is borne by the pension scheme and is thus a liability to the employer (not the employee).

The fund is separate to the company (Holden), so if there were a shortfall – such as a fall in the underlying investments– Holden would be required to top up the fund. But the company cannot draw money back out of the scheme: the employee is therefore protected if Holden were to fall on hard times.

The employee payments are not the only amount paid into the scheme: the employer is generally required to top up this amount, and this is typically a much greater contribution than that of the employee. With share markets falling in recent years and the cost of buying an income for life (eg. an annuity) increasing significantly, companies such as Holden operating this kind of scheme have seen contribution levels increase to about 20% a year!

It’s important to note that sharemarket movements have no impact on the employee’s benefit –that is, the pension income accrued – only on the employer’s need to top up the scheme.

In an environment of people living longer and low government-bond yields resulting in expensive annuities, and the expectation of share market returns continuing to fall, such a guaranteed outcome is very attractive. The recent rise in popularity of annuities in Australia shows that certainty is very important to investors.

With very few employers offering this type of scheme, employees should consider these schemes as “golden handcuffs”. If you are a member of such a scheme, we think that rolling-over your benefits to an alternative superannuation fund is not a decision to be taken lightly. |

Case study – Matt

Matt was one of the employees referred to us in the round of redundancies for advice on his options. He was married, aged 60 and had worked with Holden since the 1970s. He was unlikely to be able to work again: more than 30years of service on the factory floor had taken its toll. His primary concerns were that he needed to receive an income of around $15,000 a year and pay off his home loan. He was concerned about investing in the sharemarket, preferring something he considered simpler and easier to understand.

His accrued benefits were as follows and can be considered in two parts:

- A Defined Benefit Pension of $13,500 a year from age 65, which could be converted to a lump sum ($148,000) and rolled-over into his own personal super fund; and.

- a further accumulated super amount of $100,000, which rises and falls in value with market movements. (This was due to further additional payments that his employer was obligated to pay under the Superannuation Guarantee).

Additionally, as part of his Voluntary Service Program (VSP), he would also receive a further (redundancy) payment of $285,000 into his accumulated super.

Accumulated Super

The decision on his $100,000 plus $285,000 VSP (making a total of $385,000) was relatively straightforward and in line with comparing one “standard” super provider with another: we simply compared the costs and benefits of the Holden investment options versus another providers. We considered the Holden accumulated super scheme to be a middle-of-the-road plan, not too costly, but not boasting a huge range of investment options. In Matt’s case, $385,000 was a useful sum, as he had a mortgage that he wanted to pay off. We suggested he use $200,000 to pay off his mortgage and retain the remaining $185,000 in a low-cost super fund, which would continue to grow, tax-free.

Defined Benefit Pension

An important consideration of the Defined Benefit scheme is the ‘reduction factor’ that would normally apply if Matt were to opt for early retirement at age 60. This would see his income reduce to $10,395 a year. In this instance, part of his voluntary package was to waive the reduction factor, ensuring he retained the $13,500 a year from age 60. In either case, his transfer value remained at $148,000.

The key question, then, was whether Matt could invest the $148,000 and receive more than $13,500 a year: in other words, could he earn a return higher than the 9.1% a year the scheme guaranteed him? Although part of this could be considered a return of capital, the easiest way to demonstrate the value of this guarantee was to compare to the cost of buying a lifetime annuity. The best rate offered would have cost $250,000 (versus the $148,000 transfer value) and showed just how valuable this income benefit with Holden was.

There was an added benefit that if Matt died over the first ten years, his family would receive his $148,000, minus any payments made.

Our recommendation

We recommended Matt remain in the Defined Benefit Pension, receiving a tax-free income of $13,500 a year and using the accumulated super amount (of $385,000) to pay off his home loan. Drawing $1,500 a year to reach the $15,000 per year total he required from the remaining $185,000 within super as a tax-free income could be easily achieved – even if Matt simply wanted to invest in term deposits within his super, and not have to not worry about sharemarket movements. If he died during the first ten years, any of the remaining lump sum equivalent would be paid to his estate.

Matt also had the option of choosing a reduced pension of $11,500 a year, which would be paid for the remainder of his or his wife’s life (whoever lived the longest). Again, the $3,500pa required to top up to $15,000pa could still be easily achieved. |

My concerns

What prompted me to write this case study is that we had interviewed about 40-50 employees as part of the redundancy package offered by Holden, of which, about ten were members of the defined benefit scheme (it wasn’t available to newer employees).

In all instances, remaining and taking benefits from the defined benefit scheme was a clear “no-brainer” – yet none of the people our advisers saw opted to remain in the DB scheme. They had all received a second opinion, from another adviser , typically their local bank, and had followed the alternative advice either to roll-over into a retail superannuation fund or draw the funds out and place them in term deposits, which were “easier to understand”.

As someone with vast experience in these types of schemes in the UK and having witnessed their huge mis-selling scandals, I believe some of the advice these members received was grossly negligent.

In making our enquiries with the scheme administrator, it was clear from the responses that no one had previously requested the basic information for which we asked.. Frustrated with our queries, the response on several occasions was to the effect that in their experience, “members just transfer out anyway.Further questions revealed that there was only one member actively drawing an income from the scheme.

I find it hard to believe that of the thousands of members that have passed through the Holden scheme, only one member has chosen – or more importantly, been advised – to remain in the DB pension at retirement. It suggests a lack of understanding by the members; arguably a failure by Holden to fully inform members of the benefits of the company’s scheme; and further, demonstrates either a lack of understanding of defined benefit schemes on the part of the financial planners who have provided advice, or negligence in not making adequate enquiries. A cynic would say motivations of commissions to the advisers, and the savings Holden makes if members roll-out their super, are contributing factors. |

So why is Holden paying too much?

In analysing this scheme, I could not initially understand why Holden was effectively offering to pay such a high income rate? In some instances this was the equivalent of more than 10% a year – when market rates showed that an income of about 5.4% a year was competitive. However, if you consider the employer funding requirements using a lower rate, it makes sense.

To the layman, a larger interest rate is likely to sound better. In most circumstances, that would be correct, but in a DB pension scheme, a larger interest rate means the lump sum transfer value is lower. Our analysis showed this was typically around one-third less, but could be as much as nearly half of what the member could reasonably expect.

Drawing on the UK experience where pension schemes have minimum funding requirements that require them to provide cash equivalent transfer values that are fair and equitable, we felt obliged to investigate further whether our Holden clients were being short-changed in their transfer values.

After some digging around and queries to both the Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC), our view is that there remains a black hole in Australian funding requirements. The lax rules allow DB schemes to use uncompetitive transfer values, allowing them to reduce their funding requirements and individual transfer values*. In Holden’s example, by not updating the lump sum conversion factors since 2000 – when bond yields were about twice the current levels – the transfer values offered today are arguably considerably lower than they should be. DB means the income promised stays the same: it is the cost to replace the income that differs. Roughly, a halving of the bond yield that we’ve seen since 2000, should result in a doubling of the transfer value; but by using an old calculation, Holden members are receiving a transfer value of half to two thirds of what it you would expect it to be.

This is a risk to Holden, because if all members opted to remain in the scheme and draw a pension, the scheme would likely need need to double the funding to fill the shortfall.

It would be reasonable for employees to carry concerns as to whether the company can even fund this guarantee but Holden is part General Motors, a company with very deep pockets. |

Opportunity knocks for existing members

Whether the Holden super fund trustees are taking advantage of the loophole in funding requirements or this is just another example of the Australian financial services industry’s inability to advise clients adequately, an opportunity exists for members of this scheme.

DB Schemes offer a guarantee, a rare commodity in financial services, and in Holden’s case a very valuable and lucrative commodity. If you happen to be a member, consider yourself lucky Holden provided such a good scheme and think twice before transferring out. |

|

|

|

|

|

|

|

|

|

|

Contact Details P: 1300 55 98 69 | F: 1300 55 98 70

Office: Suite 7, 49-53 North Steyne, Manly NSW 2095 | Postal Address: PO Box 760, Manly, NSW 1655

Wealth Focus Pty Ltd ABN: 87 123 556 730 ( AFSL No: 314 872 )

© 2014 Wealth Focus Pty. Ltd. All rights reserved. |

Contact us Privacy Policy

This email is issued by Wealth Focus Pty Ltd, *ABN 87 123 556 730, AFSL 314 872. This site is directed to and available only for Australian residents. This email, attachments and web links should not in any way be construed as providing securities advice or an endorsement or recommendation of any security or product. In sending you this email we have not taken into consideration your investment objectives or your investment needs and make no representation as to the suitability or otherwise of any product, or security, to you. Before making any investment decision or purchase, you should fully satisfy yourself as to the suitability of any security or product you are considering, to your own particular circumstances, read the Prospectus, and if necessary seek professional investment and tax advice. We recommend that you read our Financial Services Guide and Investment Notes.

The article above is written as a reflection of our views in an attempt to illustrate the valuable benefits offered by this scheme. The case study above relies heavily on the reduction factor being waived in early retirement. We believe that even with the application of a reduction factor, the benefits remain attractive. However, each client circumstance and needs can vary significantly and investors should seek their own Personal Advice in assessing the suitability of opting for a defined-benefit Pension at retirement.

* Low transfer values may also be justified on the basis of lower life expectancy and the scheme’s almost non-existent need to fund ongoing pensions due to almost all members transferring out. |

|

The Insider

The Insider Holden Defined Benefit Pension Scheme

Holden Defined Benefit Pension Scheme