|

|

Sandon Capital Investments Limited

An opportunity to invest in a Listed Investment Co. from a highly skilled activist investment firm |

Wealth Focus has secured access to an allocation to the Sandon Capital Investments Limited IPO. Investors looking to apply for a broker firm allocation will need to contact us on 1300 559 869.

Sandon Capital - A highly skilled activist investment & advisory firm

Sandon Capital has just announced the launch of a new Listed Investment Company (LIC), Sandon Capital Investments Limited and aims to raise a maximum of $125 Million. Its our view that their track record and client list (WAM, Mercentile), just goes to demonstrate the quality of this manager.

The free option for all subscribers of the IPO is just gravy.

Activist Investing

For those unfamiliar with the term, activist investing is where an investment company such as Sandon, takes a position and proactively encourages the company to make changes for the benefits of shareholders. This can include changes to dividend policies, overall corporate strategy, board and management, as well as changes through corporate activities, such as takeovers or divestitures. ie proactive value investing for the benefit of shareholders. |

|

|

|

|

|

|

Key Features

- Broker firm offer - Our allocation through the broker firm offer means investors are more likely to achieve their desired allocation without risk of scaleback through the general offer.

- Limited Offer – The offer is to raise $125 Million, with the ability to raise less. The shares will be traded on the ASX.

- Activist Investment Strategy - Whereas most value managers aim to buy underpriced investments, activist managers aim to take this one step further by using shareholder rights to proactively re-price undervalued companies.

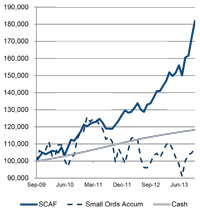

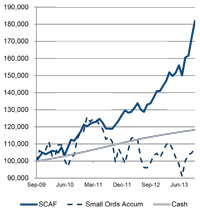

Exceptional Investment Performance - Sandon have arguably demonstrated their ability to invest in this manner within the unlisted version of their managed fund (wholesale investors), providing investors with an average return of 15.5%pa since inception in Sep 2009. - (Past performance is no guide to future performance. Chart and disclaimer p.11 of presentation*) Exceptional Investment Performance - Sandon have arguably demonstrated their ability to invest in this manner within the unlisted version of their managed fund (wholesale investors), providing investors with an average return of 15.5%pa since inception in Sep 2009. - (Past performance is no guide to future performance. Chart and disclaimer p.11 of presentation*)

- Free option - Each investor will receive a free option for each share subscribed to in the IPO. Our estimated value - 8c

-

Minimum investment - $10,000 (this is a Wealth Focus minimum)

- Issue Price - $1.00 per share plus a free option

|

|

|

Find

out more

If you

would like further information on the Sandon Capital Investments Limited Offer,

please click on the links below:

Please call us on 1300 559 869 to ask us to secure an allocation. |

|

|

Best regards

Sulieman Ravell

Wealth Focus Pty Ltd

|

| |

|

|

|

|

|

|

What do we get paid?

Wealth Focus will receive a payment of up to 1.75% plus GST of the amount invested.

|

|

|

|

|

Contact Details P: 1300 55 98 69 | F: 1300 55 98 70

Office: Suite 7, 49-53 North Steyne, Manly NSW 2095 | Postal Address: PO Box 760, Manly, NSW 1655

Wealth Focus Pty Ltd ABN: 87 123 556 730 ( AFSL No: 314 872 )

© 2013 Wealth Focus Pty. Ltd. All rights reserved. |

Contact us Privacy Policy

This email is issued by Wealth Focus Pty Ltd, *ABN 87 123 556 730, AFSL 314 872. This site is directed to and available only for Australian residents. This email, attachments and web links should not in any way be construed as providing securities advice or an endorsement or recommendation of any security or product. In sending you this email we have not taken into consideration your investment objectives or your investment needs and make no representation as to the suitability or otherwise of any product, or security, to you. Before making any investment decision or purchase, you should fully satisfy yourself as to the suitability of any security or product you are considering, to your own particular circumstances, read the Prospectus, and if necessary seek professional investment and tax advice. We recommend that you read our Financial Services Guide and Investment Notes. * Performance to 31st October 2013 (source Sandon Capital Presentation). Chart demonstrates the actual performance of Sandon Capital Activist Fund (unlisted fund, not the Company). It is not a forecast or predication of the likely performance of the Company. Future performance of the Company is not related to the past performance of SCAF and is not guaranteed. SCAF returns are net of all fees and expenses. |

|

Exceptional Investment Performance - Sandon have arguably demonstrated their ability to invest in this manner within the unlisted version of their managed fund (wholesale investors), providing investors with an average return of 15.5%pa since inception in Sep 2009. - (Past performance is no guide to future performance. Chart and disclaimer p.11 of presentation*)

Exceptional Investment Performance - Sandon have arguably demonstrated their ability to invest in this manner within the unlisted version of their managed fund (wholesale investors), providing investors with an average return of 15.5%pa since inception in Sep 2009. - (Past performance is no guide to future performance. Chart and disclaimer p.11 of presentation*)