The search for income in a low interest rate environment

Government bonds performed well for investors in 2008 whilst coporate bonds were overlooked. We consider the opportunity for investors in 2009, whether government bonds now look to be overvalued and how to gain exposure to this sector.

The ructions in investment markets over the past 20 months have produced an unusual investment opportunity: equity like returns with bondholder security. Investment grade corporate bonds are offering double digit returns which ordinarily, would be difficult to fathom in a low inflation environment.

With the government dropping interest rates almost on a monthly basis, many investors are now looking to the bond market as a fixed interest alternative. 2008 saw a mass exodus from equities and to some extent from corporate bonds into Government issued bonds, as investors looked for a secure fixed income. This has in turn pushed bond prices up, reducing the percentage yield. e.g. a $5 income on a $100 bond is 5%, but a rise in price to $200 still providing a $5 income means the yield has now dropped to 2.5%.

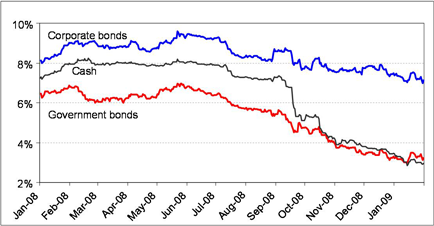

The widening of the gap between corporate bond and government bond yields whilst cash rates continue to drop has made corporate bonds an attractive proposition for investors

Historically the gap between the yield offered by high grade corporate bonds and government bonds has been relatively small.

In 2008, the gap between corporate and government bonds has widened significantly. The uncertainty of which companies will be able to service their bonds as well as hedge funds liquidating bond holdings (for liquidity reasons) has meant that the price of government bonds has soared whilst corporate bonds have languished in 2008.

Our feature on Vianova this month highlights a fund we believe is well placed to take adavantage of the current mispricing of corporate bonds.

The widening of the spread between Aussie corporate and government bond yields whilst 6 month term deposits drop

January 08 to February 09

|

What are corporate bonds?

In its simplest form a corporate bond is a loan to a company. In exchange the company agrees to repay you a fixed or floating rate of interest for a fixed period of time, after which, it will need to repay the original amount borrowed.

Since you can trade them on the stockmarket, the value of bonds can rise and fall. e.g a drop in interest rates can make bonds more attractive, pushing up the value as investors flock to lock in a higher rate of interest than is currently offered on the high street.

For many, a higher rate of interest is an attractive prospect, especially in these times of low interest rates and fears of global deflation. However, corporate bonds are not without risk, the company who has issued them could default on interest or the capital repayment. As a result, you may see some bonds offering yields as high as 20% as investors price in the uncertaintity.

Having said that, there are a large number of high grade, profitable companies with bonds well below the price they will eventually be redeemed, providing an excellent opportunity to benefit from high yields and potential for capital growth.

In light of the increased risk of defaults in the current economic climate, we recommend investors seek to invest through an established managed fund and look to avoid some of the “High income” funds that are primarily investing in lower grade/higher risk bonds.

This ensures that you diversify your investments into bonds and benefit from the expertise of a professional who seeks to provide you with optimum returns.

![]()

Contact Details P: 1300 55 98 69 | F: 1300 55 98 70

Office: Suite 7, 49-53 North Steyne, Manly NSW 2095 | Postal Address: PO Box 760, Manly, NSW 1655

Wealth Focus Pty Ltd ABN: 87 123 556 730 ( AFSL No: 314 872 )

2008 Wealth Focus Pty. Ltd. All rights reserved.