The disparity between corporate bond and government bond yields mean that opportunity exists for the right manager.

Looking at the best performing funds over the last year, its apparent that bonds have dominated the performance tables and with interest rates anticipated to drop further, underpriced bonds seem an attractive proposition for 2009.

Looking at bond yields, investors generally think that the higher the yield the better the investment. What has historically been considered a simple choice of choosing the fund with the highest yield, is now littered with real concern due to the bond issuer’s ability to repay debt. Large companies like Allco, ABC Learning and MFS are examples of established institutions defaulting on their payments.

Choosing the right manager to evaluate the credit risk of each issuer is vital in this market since there are a whole variety of bonds and bond hybrids which you can invest into.

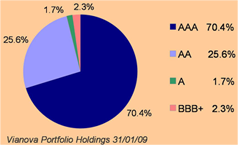

Vianova Strategic FI Trust holdings

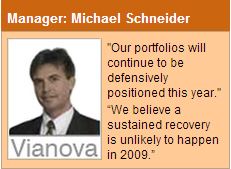

The Vianova Strategic Fixed Interest Trust is well placed to take advantage of these opportunities. We feel that the fund’s emphasis on Australian fixed interest should help shelter it from some of the credit problems that are more prevalent in the overseas credit markets. Furthermore, the high allocation to non-government, high grade bonds should mean that it is well placed to benefit from a rise in corporate bond prices.

The Vianova Strategic Fixed Interest Trust is well placed to take advantage of these opportunities. We feel that the fund’s emphasis on Australian fixed interest should help shelter it from some of the credit problems that are more prevalent in the overseas credit markets. Furthermore, the high allocation to non-government, high grade bonds should mean that it is well placed to benefit from a rise in corporate bond prices.

(We note that the fund’s allocation to non-coupon bonds currently reflects the opportunity for higher capital returns offered by these investments. However, with a current yield of around 4.5%, this should still provide investors with a higher return than currently offered by many of the high street banks in addition to the greater potential for growth)

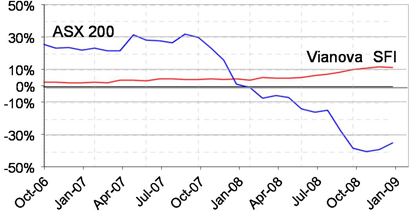

Performance of the Vianova Fixed Interest Trust vs ASX 200

October 2006 to January 2009

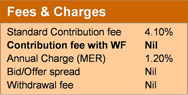

Rebate Offer: 4% Rebate (100% initial commission)

Minimum Investment: $1,000

Disclosure:

Wealth Focus will rebate 100% of the 4% sales commission. Wealth Focus may also receive a trailing commission of up to 0.44%p.a. This trailing commission is paid by the manager and is NOT an additional charge to the investor.

Documents & Links:

![]()

![]() Application/PDS link

Application/PDS link

![]() AU Vianova Strategic FI Factsheet

AU Vianova Strategic FI Factsheet

AU Vianova Strategic FI webpage

Contact Wealth Focus on 1300 559 869 for more information.

Current running yield = 4.52% (as at 23/02/09)

Comment: