Although many investors feel that it is a fund managers job to disinvest from equities in a downturn and move back into equities as they bottom out. Most managed funds are constrained by their mandate to remain invested in equities at all times.As an unconstrained absolute return fund, the BlackRock AAA Fund’s ability to take advantage of opportunities in any market provided investors with exceptional returns in 2008.Having discussed the pros and cons of hedge funds in general and highligting why we currently favour managed future funds in a falling market, we would be doing our readers a diservice if we didn’t provide an alternative for those who like the idea of an individual managing the fund on a day to day basis. We feel that BlackRock’s Asset Allocation Alpha (AAA) Fund provides just that alternative.

Although many investors feel that it is a fund managers job to disinvest from equities in a downturn and move back into equities as they bottom out. Most managed funds are constrained by their mandate to remain invested in equities at all times.As an unconstrained absolute return fund, the BlackRock AAA Fund’s ability to take advantage of opportunities in any market provided investors with exceptional returns in 2008.Having discussed the pros and cons of hedge funds in general and highligting why we currently favour managed future funds in a falling market, we would be doing our readers a diservice if we didn’t provide an alternative for those who like the idea of an individual managing the fund on a day to day basis. We feel that BlackRock’s Asset Allocation Alpha (AAA) Fund provides just that alternative.

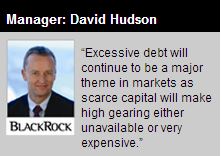

Part of one of the world’s largest investment banks, the investment manager is able to draw on BlackRock’s vast global research teams in recognising investment opportunities that arise.

We note that the fund is unconstrained in the products or sectors it can invest into, allowing the manager to take advantage wherever he sees opportunity and this is reflected in the fund’s performance since its launch in 08. Investors should note that due to the unconstrained nature of assets the fund can invest into, this fund should be considered higher risk.

The manager’s heavy allocation to government bonds helped the fund grow by 29.31% in the 6mths to Dec 08.

We feel that the BlackRock AAA Fund provides investors with a good alternative for those looking for an actively managed absolute return fund. Our concern with unconstrained investment funds is the higher possibility of decisions on a whim, however, as one of the largest investment banks in the world, BlackRock is more likely to have a tighter hold on risk management and its access to vast research resources is likely to ensure investment decisions have proper due diligence.

Rebate Offer: 4% Rebate (100% initial commission)

Minimum Investment: $1,000

Disclosure:

Wealth Focus will rebate 100% of the 4% sales commission. Wealth Focus may also receive a trailing commission of up to 0.5%p.a. This trailing commission is paid by the manager and is NOT an additional charge to the investor.

Documents & Links:

![]()

![]() Application/PDS link

Application/PDS link

![]() BlackRock AAA Fund Profile

BlackRock AAA Fund Profile

BlackRock AAA webpage

Contact Wealth Focus on 1300 559 869 for more information.

Comment: