INSTREET LINK ARC

| Fee Rebate | 0.75% of notional exposure |

| Min Investment | $2,950 ($25k notional) |

| Expected Close | 11/12/2009 |

|

|||||||||||

|

|||||||||||

| INstreet Link ARC provides investors with the opportunity to access a $100,000 exposure in a systematic computer driven investment program with only $11,800 investment. The managed futures program to provide absolute returns from commodites markets in both rising and falling markets. | |||||||||||

| Key features and benefits | |||||||||||

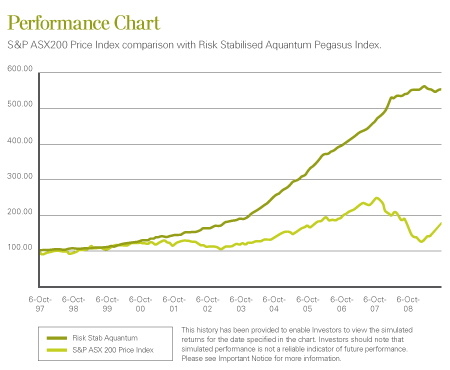

| Leveraged Exposure – By investing in Instreet Link ARC deferred purchase agreements (Units) provide investors with the opportunity to gain leveraged exposure to the price growth potential of Risk Stablised Aquantum Pegasus Index. Investors are able to access $100,000 notional exposure for an $11,800 initial investment and may be an effective means for investors and SMSFs with limited funds to gain leveraged commodities exposure.Aquantum Pegasus Index – The Index aims to deliver absolute returns with a low level of volatility. Based on an extensive 12-year empirical analysis by RBS, the Index has recorded positive returns every calendar year.Sophisticated computerised process – 100% systematic and relying solely on computer driven trading, the Aquantum Pegasus Index identifies trends and exploits inefficiencies in commodity markets around the world

Strong Pedigree – Aquantum Algorithmic Limited is a specialist provider of absolute return strategies. Its principal, Thomas Morrow, has been developing algorithmic trading strategies since the late 1980’s with companies such as Bankers Trust, Deutsche Bank and Winton Capital before creating Aquantum. Annual payment of any gains – Gains are distributed at the end of each year, allowing investors to lock in their profit at the end of year 1 (or reset at a lower level in the event of a loss) Diversifying a traditional investment portfolio – It is widely accepted that a traditional investment portfolio can benefit from the additional diversification provided by managed futures programs such as the Aquantum Pegasus Index. |

|||||||||||

|

|||||||||||

| Important Information * The returns are based on the increase on the Risk Stabilised Aquantum Pegasus Strategy Index over the specified month. The simulated performance uses the historical values of the Risk Stabilised Aquantum Pegasus Strategy Index (USD) as published by Bloomberg. Investors should note that in calculating the simulated returns, they have been calculated based on back-testing using historical data of the Underlying Index from the period of 6 October 1997 until 6 September 2009. All fees, costs and charges of the Underlying Index have been taken into account when calculating the simulated returns. In addition, the simulation assumes that the Reference Index was not terminated by the Reference Index Calculation Agent and where there was a Market Disruption Event or other event which prevented the publishing of a Reference Index Value, the Issuer has used a level on the following Business Day |

|||||||||||

What do we get paid

Wealth Focus will rebate 50% of the 2% sales commission by reducing the cost of the initial investment ($11,800 entry cost will be reduced to $10,800). Wealth Focus does not receive a trailing commission for this product. Initial commission is paid by the product provider and is NOT an additional charge to the investor.

Comment: