ACORN CAPITAL INVESTMENTS FUND

| Minimum Investment | $10,000 |

| Expected Close | 22/04/2014 |

Wealth Focus has secured access to an allocation to the Acorn Capital Investments Fund IPO. Investors looking to apply for a broker firm allocation will need to contact us on 1300 559 869 by close of business Thursday 10th April.

Allocations may still be available after this date but will be allocated on a first come first served basis.

Acorn Capital – Long term growth from small cap/microcap securities

Acorn Capital has just announced the launch of a new Listed Investment Company (LIC), Acorn Capital Investments Fund. Aiming to raise a maximum of $100 Million: it’s our view that due to a strong board that sits across a number of different brokers, we are likely to see some demand on this issue.

Experienced small cap manager with a strong track record

We note Acorn have demonstrated their stock picking ability with a track record in a similar strategy producing returns of 25%pa† and outperforming the Small Ords Accumulation index by over 15%pa.

As is always the case with Listed Investment Companies (LICs), our primary concern is the discount we often see LICs trading at. Managers focused on growth have shown a tendancy to trade at larger discounts than their income focused peers. This is arguably down to the typical LIC investor being older and looking for income/franking credits.

We note one of Acorn’s Unique Selling Points is the allocation to unlisted investments and agree that this strategy is best utilised within a closed end fund such as a LIC. However, investors should note that the opaque nature of these investments can be viewed as a disadvantage by the market when assessing whether a LIC should trade at a premium or discount to its underlying investment value.

Overall, we feel that this LIC carries a higher risk of trading at a discount to its larger cap peers, however, Acorn have a large investment team that have successfully demonstrated their ability to perform with a very good track record. Although we think the potential for outperformance compensates you for this risk, it is something investors should be conscious of.

We find reassurance that Acorn manages similar strategies within their unlisted vehicle and institutional manadates. This would lead us to believe that a large discount is likely to be buoyed by the unlisted strategies soaking up deeply discounted shares. The free option to each share listed under the IPO (we value at approximately 6-7c) further compensates investors for this risk and is likely to result in a net gain on listing.

Call us on 1300 559 869 to ask us to secure an allocation.

Key Features

- Broker firm offer – Our allocation through the broker firm offer means investors are more likely to achieve their desired allocation without risk of scaleback through the general offer.

- Size of offer – The offer is to raise $100 Million, with the ability to raise less. The shares will be traded on the ASX.

- Invest in small cap/microcap strategy not previously avilable to retail investors – Acorn will invest in listed and unlisted companies with market capitalisations below the ASX 250. Extending the investment universe beyond listed investments has allows Acorn to capitalise on green shoots not typically available to retail investors, leading to significant outperformance of the Small Caps index.

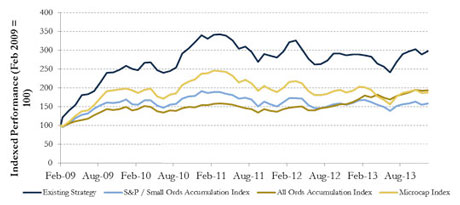

Performance of Existing Strategy against ASX Indices†

Past performance is not a guide to future performance. Figures shown are pre-fees and taxes

- Successful track record – The historical performance of a similar strategy managed by Acorn has achieved a (pre-fee and taxes) performance of 25%pa† since inception in 2009.

- Free option – Each investor will receive a free option for each share subscribed to in the IPO.

- Minimum investment – $10,000 (this is a Wealth Focus minimum)

- Issue Price – $1.00 per share plus a free option

Find out more

If you would like further information on the Acorn Investments Fund Offer, please click on the links below:

Please call us on 1300 559 869 to ask us to secure an allocation.

Best regards

Sulieman Ravell

Wealth Focus Pty Ltd

What do we get paid?

Wealth Focus will receive a payment of up to 1.5% plus GST of the amount invested.

Comment: