MYOB SUBORDINATED NOTES

| Minimum Investment | $10,000 |

| Expected Close | 19/12/2012 |

A high yielding income investment in MYOB

OFFER NOW CLOSED

Wealth Focus has secured access to the MYOB Subordinated Notes IPO. Investors looking to apply for a guaranteed allocation will need to contact us on 1300 559 869.

Allocated on a first come first served basis.

MYOB Notes – Income above 10%pa

This issue has many of the hallmarks of an attractive hybrid, a fixed term of 5 years, a relatively small offering of only $125 Million, unfranked income, cumulative distributions with a 2%pa penalty in the event of suspending payments, a well known brand with a strong market share and a large proportion of income from recurring revenues.

However, investors should note that equity-like returns don’t come without risk and we think investors should consider it a fixed income product with equity type risk.

With only $125 Million on offer, we expect this issue to be heavily oversubscribed as investors happy with investing in equities look for the security of income. We anticipate this offer will close early and the price to be set at 6.70% over the BBSW (indicative rate of 9.97%pa – 26/11/12).

- Download a prospectus

- Download a fact sheet

- Download our analysis

- Webinar – An Introduction to Fixed Income

Call us on 1300 559 869 to ask us to secure an allocation.

Key Features

- Broker firm offer – Our allocation through the broker firm offer means investors are more likely to achieve their desired allocation without waiting for the general offer.

- Limited Offer – The offer is to raise $125 Million, with the ability to raise more or less. The shares will be traded on the ASX

- Income – MYOB Subordinated Notes provide holders with quarterly unfranked distributions.

- High level of income – The indicative distribution rate is 6.70% over the 90 day Bank Bill Swap Rate (3.27% – 26/11/12) for an indicative rate of 9.97%pa.

- Minimum interest rate for the first four periods – A minimum of 10% for the first four interest payments.

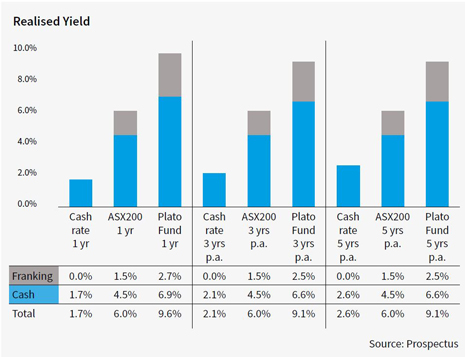

- Un-franked Income – Investors often overlook that returns quoted on fixed income include the franking credits. Un-franked payments should be considered more attractive, avoiding the need to wait until the end of the tax year to claim back the franking.

- Minimum investment – $10,000 (this is a Wealth Focus minimum)

- Issue Price – $100

Find out more

If you would like further information on MYOB Subordinated Notes Offer, please click on the links below:

- Fact sheet

- Prospectus

- Research

- Our analysis

- View our online webinar – An Introduction to Fixed Income

Please call us on 1300 559 869 to ask us to secure an allocation.

Best regards

Sulieman Ravell

Wealth Focus Pty Ltd

What do we get paid?

Wealth Focus will receive a payment of up to 1% plus GST of the amount invested. This commission is paid by the product issuer and is NOT an additional charge to the investor.

Comment: