Flexibility is everything

Flexibility to allocate significantly to cash can be an advantage when you see the signs that a market is over-heating.

The GFC provided the perfect stage for Han Lee of Prime Value to show off his skills in capital preservation in volatile equity markets.

Having launched in 1998 and won several awards over the years, Prime Value has proven to be a boutique manager to watch.

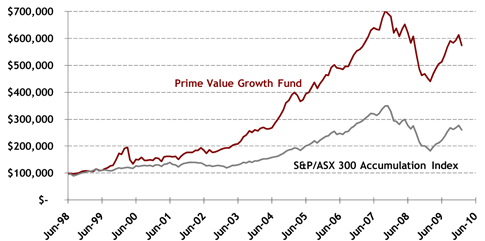

Higher returns with lower risk

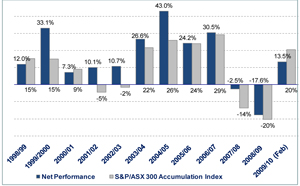

A prime example of the benefits of investing with boutique managers is the Prime Value Growth Fund. This fund has outperformed 16 out of the top 20 largest Aussie Equity funds over the last 5 years and yet has managed to maintain a lower level of volatility (risk) than 19 of these funds.

Fund Performance (31/01/2010)

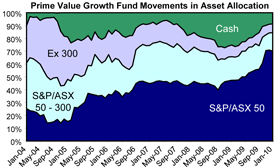

Not afraid to move to cash

Fund Manager, Han Lee’s conviction that the markets were beginning to look overvalued, saw a gradual shift in focus towards larger/more secure companies and the credit crunch saw the fund increase its allocation to cash increase to nearly 30%.

Outperforming due to a flexible investment strategy

We feel that the changing investment landscape means that managers with flexible strategies are likely to benefit. Prime Value has successfully demonstrated this capability, initially outperforming from smaller caps before an early shift in focus towards resources then moving towards larger cap stocks and cash.

Rebate Offer: No Entry Fee

Minimum Investment: $20,000

Disclosure:

Wealth Focus may receive up to 0.6% as a marketing commission. This is paid by the manager and is NOT an additional fee to the investor.

Documents & Links:

Application/PDS link

Prime Value Growth Fund Summary

Prime Value Growth Fund webpage

Contact Wealth Focus on 1300 559 869 for more information.

Comment: