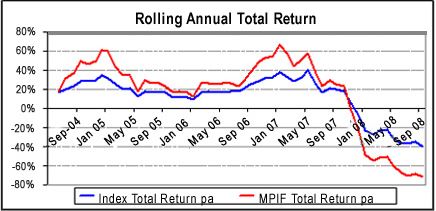

What was one of the top performing funds in the 4 years to June 2007, boasting a return of 27.8%pa, the MPIF has fallen more than most.

We question Leo Economides as to the reasons behind the fund’s recent poor performance and whether recent falls in this sector represent an opportunity for investors in this sector.

What is your overall aim for the fund and how does your fund differentiate itself?

The fund is the only domestic geared property securities fund in the market and as such, it is designed to use the gearing to provide investors with outperformance over the long term. The fund aims to pay a high after tax income, as a result of the fact that the underlying managers are mainly active (ie they trade securities to generate profit, which we in turn distribute).

We’ve seen a dramatic fall across global equities due to the credit crunch. Why have Listed Property Trusts (LPTs), an asset class that is considered by many to be relatively stable, been hit harder than other sectors?

You are right in that LPTs are considered stable. The largest falls previously in the LPT sector were more like 20% during the 1987 stock market crash. Since the recent credit crunch, debt is harder to obtain and the cost of borrowing increased despite interest rates falling, which has in turn led to a fall in prices for LPTs.

Furthermore, LPTs became overpriced from the end of 2006, with considerable offshore funds pushing up LPT prices. Assuming that the market was 20% overvalued around that time, some correction was likely – but a 60% fall has surprised everyone in the market.

If the problems are mainly with US lending then why have LPTs in Australia fallen so dramatically?

What has happened over the last few years is that additional risk has crept into the sector as a result of; 1. Higher levels of gearing, 2. Increased offshore exposure and 3. Some LPTs earning significantly more of their profits from business activities.

The sudden credit crunch highlighted these increased risks and the market has brought the LPT prices down as a result.

I note that your fund has fallen by over 70% in the year to 30 September 2008, that’s quite a significant fall. A lot of our readers have exposure to your fund, could you explain how this has come about and how does this compare to the overall sector?

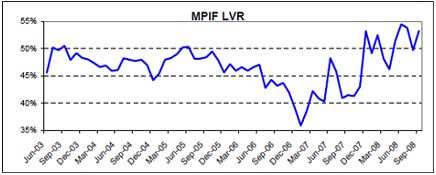

It’s important to note that MPIF’s internal gearing magnifies returns and losses. MPIF performed well in its first four years. LPT prices were going up and the target gearing of 50% in MPIF enhanced the returns. When the LPT sector fell, (by 60% over the last year) this worked against us.

During 2007, MPIFs gearing was reduced to 35%-45%, in recognition that the LPT sector was overvalued. With the fall in LPTs our active gearing management has brought this back up to 45%-50%, and whilst it is still detracting from returns in a down market, individuals are not burdened with their own margin loan or passive gearing strategy (both of which are full recourse to the borrower).

Your fund has produced a good income stream for investors since its launch in 2003. With distributions typically around the 13-15% and some years as high as 36%, why have you recently not paid a distribution?

Surely if the underlying investments in property are receiving the same rent, distributions should be the same?

During the first 4 years of the fund distributions have been high. This was a result of a combination of low interest rates, high distributions from LPTs, significant capital gains being distributed by our underlying managers (MBL and CSAM) and of course, the gearing.

Over the last 12 months LPT values fell, interest rates rose and there were virtually no capital gains distributed by the underlying managers.

Also, many LPTs have in the recent reporting period, re-based their distributions to more accurately reflect core earnings, rather than one-off or business profits, reducing distributions for the sector as a whole by around 5%-10% over the previous year. Subsequent to that, some LPTs also changed their distribution frequency (ie quarterly to half yearly or annual) creating a short term impact on cash flowing in.

For the September 2008 quarter, MPIF paid no distribution for the first time. This is a direct result of sticking to our policy of collecting the distributions received by the underlying managers, paying interest (for the internal gearing), some of the fund costs, then distributing the balance.

Whilst we cannot say for certain, we feel this is a one off, rather than the fund not paying future distributions.

In light of all the turmoil in the market what changes, if any, have been made to the fund?

Firstly we have looked at our gearing model, which has served us well for the last 5 years. We have concluded that the model is fine, but that we need to apply a Gearing Overlay to make adjustment in extreme market circumstances. At the moment the Gearing Overlay is indicating the market volatility requires us to lower target gearing by around 5%.

We have also introduced a new fund to the multi-manager strategy – the Macquarie True Index Listed Property Trust. This fund guarantees exact index returns and is not normally available to retail investors. We will gradually work towards a 20% allocation over time.

Where do you see listed property index heading going forward?

The market looked expensive during 2007, and the subsequent correction proved that. What has happened is that the market appears to have over-corrected due to sentiment. It looked cheap in March 08, cheaper in June 08 and even cheaper now.

Many LPTs are trading at around a 30% discount to their underlying Net Tangible Asset value (NTA). This is because there is concern over the viability of some of LPTs, ie the market has priced in the need for these LPTs to “repair their balance sheets” by selling assets and repaying debt or raising fresh capital.

As the LPTs successfully move down this path we will see the NTA value come back in the LPT prices. This will take time, but we are already seeing the early signs with some LPTs commencing the repairing process.

Units in MPIF are issued by Macquarie Direct Property Management Limited (ABN 56 073 523 784). Investors should consider the PDS when deciding whether to invest.

Comment: