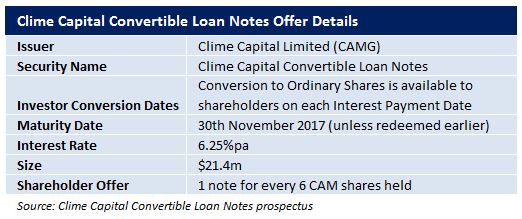

Clime Capital has just announced the launch of a new income offer: Clime Capital Convertible Loan Notes. Access is available through the shareholder offer before listing in December.

The Notes will pay a quarterly coupon at 6.25%pa and are due to mature 30th November 2021. The Note will be tradable on the ASX.

This issue will be used to invest in securities listed on the ASX, recognised international exchanges and selected unlisted investments.

Clime Capital

For those not familiar with Clime Capital (Clime), they are a Listed Investment Company with a history that spans over 16 years and manage $82.26 Million (31/10/17). Their fund invests in Australian and International equities (management fees of 1%pa + 20% performance fee over benchmark).

Imitation is the sincerest form of flattery

If you had invested in the AFI Convertible Notes (ASX code: AFIG) issued in December 2011, you could be forgiven for thinking the terms sound very familiar. We wrote about AFIG at the time and felt that they offered excellent value for money, using them extensively within our client portfolios until they matured in February this year. That offered investors a fixed term bond of just over 5 years at 6.25%pa, plus a conversion option should the share price rise by more than 25% (from issue price). Investors who converted at maturity benefited from the 6.25%pa plus an approximate 10% at maturity if they elected to convert.

Paying to invest

You may question Clime’s rationale of paying 6.25%pa to invest when institutional rates would allow them to borrow at a lower rate. However, this is an exercise in allowing investors to have their cake and eat it;

- Investors looking for the security of a bond like investment are able to benefit from 6.25%pa until maturity in 4 years.

- Investors further benefit by being able to convert to ordinary shares at a fixed price of 96c per share, approximately 10% above the current share price

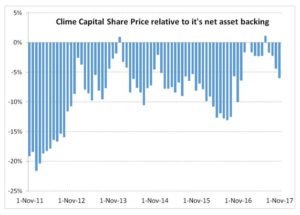

The issue Clime Capital has is that in order to grow the company, they need to attract new shareholders, however, since the company is currently trading at a discount to Net Tangible Assets (NTA), and any capital raised would further dilute the existing NTA.

A Convertible Note allows Clime to attract new funds, leveraging their investment returns with the benefit of increasing the shareholder base should Noteholders convert when the share price exceeds 96c.

With Clime Capital’s share price currently sitting at 6% below Net Asset Value (NAV) and recent trends in LIC’s moving towards narrower discounts/premiums, we can easily anticipate a 10% move in the share price providing investors with the opportunity to converting their Notes for a premium. In effect, investors are receiving a fixed income return with a free option over an equity fund.

Attractive Pricing

In our opinion, the Notes look reasonably attractive on a number of measures;

- 4 year term deposits are typically below 3.00% pa. Term Deposit rates are fixed for four years with financial penalties should you wish to exit early. Clime Capital Convertible Loan Notes allow you to access a greater 4 year return at 6.25%pa with market liquidity should you wish to exit early (subject to market pricing).

- The conversion option is not dissimilar to having a (American Style) call option over ASX 200 for 4 years with a 10% hurdle. We would expect retail investors to pay close to 8% for this type of exposure (6% if you feel CAM’s discount may widen), rounding the equivalent return to just over 8%pa.

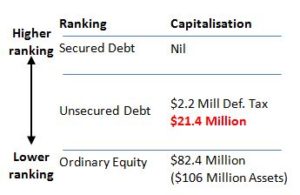

- Currently there are only deferred tax liabilities of $2.2 Mill of debt against a company of over $84 Million dollars in assets. An estimated $23.8 Mill after this raising. Clime Capital pledge that the total indebtedness will not exceed 40% of the total assets.

Our view

Clime Capital Convertible Notes offer one of the best risk return profiles of hybrids currently listed.

The key risk with this issue is a likely lack of liquidity in the secondary market, but we wouldn’t anticipate many sellers while rates remain so low.

With only $21.4 Million available, of which $7 Million is set aside for the placement offer, and the remainder for the shareholder offer, investors who are not CAM shareholders will have to wait until it lists before being able to buy.

Note: Clime Capital Convertible Loan Notes will be listed on the ASX and as such the price of the Note’s will be subject to market movements. Investor’s selling on market may receive a price lower (or higher) than the issue price.

Key features

- Fixed return of 6.25%pa – Paid quarterly in arrears

- Maturity in 4 years

- Negative Covenant – The issuer must not without approval of an Ordinary Resolution, increase total debt above 40% of total assets

- Option to convert – CAMG Notes to Ordinary CAM shares at a fixed price of 96c per share at any time during the 4 year term

- Quarterly unfranked interest – Often overlooked by investors, hybrid returns are typically quoted inclusive of franking credits. Unfranked payments are therefore more attractive, avoiding the need to wait until the end of the tax year to claim back the franking.

Comment: