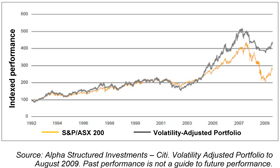

Investors who keep a close eye on Capital Protected Products and other Structured Investments will have noticed a shift in focus towards products that have a volatility overlay. This approach has generally provided investors with a smarter way of investing, basing the investor’s exposure on a comparison in the current market risk (measured by volatility) against the long term market volatility average. ie reducing exposure to the underlying investments as risk increases and increasing exposure as risk decreases.Although our comparison table compares the capital protected offers currently available and provides an at a glance view on some of these products, there are a number of emerging trends and news in the structured products space we have tried to highlight.

Investors who keep a close eye on Capital Protected Products and other Structured Investments will have noticed a shift in focus towards products that have a volatility overlay. This approach has generally provided investors with a smarter way of investing, basing the investor’s exposure on a comparison in the current market risk (measured by volatility) against the long term market volatility average. ie reducing exposure to the underlying investments as risk increases and increasing exposure as risk decreases.Although our comparison table compares the capital protected offers currently available and provides an at a glance view on some of these products, there are a number of emerging trends and news in the structured products space we have tried to highlight.

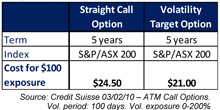

Volatility overlay provides reduced costs

Volatility overlay provides reduced costs

A side effect of reducing the overall risk is that investors are able to benefit from increased returns in times of low volatility and a reduced cost of the underlying investment. Since issuers of index linked products have to hedge the underlying investments, having a reduced exposure when volatility is high and costly to hedge means that there is a reduced cost associated with these products. The last year has already seen a number of structures introduce a volatility overlay to their products. When you consider the rationale for volatility targeting, and see how it can deliver real benefits in practice, it’s clear that volatility overlays are not something to shy away from and are here to stay.

Read more on Volatility Overlay Pricing in our March 2011 issue

Comment: