With investors seeing the investment markets moving more in a day than in a whole year, the mental uncertainty this creates means that investors can find themselves sitting in the sidelines watching the window of opportunity pass them by. We find it very easy to throw money at the markets when times are good but are reticent to invest when the market has fallen and prices are low.

I’ve been giving a lot of thought to the psychology of investing and why we have a tendency to repeat the same mistakes, buying high and selling low? Why do we find it so difficult to buy the same investments, now costing half as much today as they did a year ago? Surely we should be filling our boots?

Emotional Investing

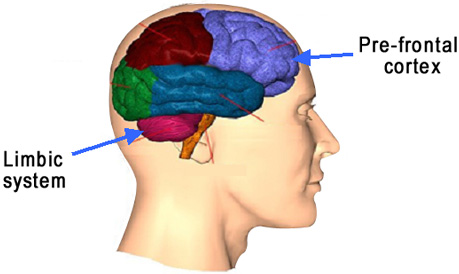

The simple answer is we are all emotional investors. What many of us don’t realise is that the hard wiring of our brain disadvantages us in some ways when it comes to making investment decisions. Our rational logical centre is dealt with in the front of our brain (pre-frontal cortex), whilst the Limbic system, located at the back of the brain, deals with both motivation and emotion. This means that our decision making process is much more likely to involve emotional input leading to us buying when we get excited at market peaks and selling as fear sets in when markets start to fall.

|

Creating the bubble

We also have a tendency to “Herd”, inadvertently getting caught up in the actions of those around us. It’s perfectly natural to want to “dip your toe” when your neighbour, colleague and best friend have all made a quick buck and are encouraging you to do the same.

Multiply this by thousands of investors each reaffirming each other’s decisions and you have the makings of a bubble. The same thing happens when the market is falling, we sit tight on investments that we should have sold out of because we have become emotionally attached to them and only sell out when everyone around us is doing the same. The exact opposite of what we should do.

Research in the US in 2007 showed that over a 20 year period investors using the typical “Fear and greed” strategy only achieved a 4.3%pa return, yet a “Disciplined” strategy achieved 11.8%pa return.

Looking for a sure thing

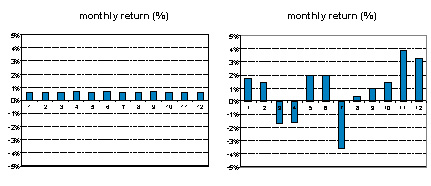

Consider which of the following investment scenarios you would choose?

|

A return of 10% pa (on the right) is the logical solution, yet the 5% pa (on the left) is the one we tend to favour. This is because we naturally favour certainty particularly in times of stress as its easier for us to comprehend.

Whether you are a DIY or professional investor, you will be affected by these irrational investment choices and helps to explain why many of us feel that we can beat the market. Professional managers have a whole range of sophisticated indicators in place to overcome this problem. As DIY investors we need to recognise that we will feel this way and structure our investments in a manner to stop our natural “Fear and Greed” instincts.

So if we are hard wired to make the same mistakes, what can we do to stop ourselves falling into the trap of buying high and selling low?

Just being aware that you have a tendency towards emotional investing, can help influence your decision making. This then allows you to question whether you are making a decision based on logic or emotion.

Diversify your investments across a range of asset classes. Many of us understand that diversification allows you to reduce your risk but don’t necessarily understand how poor diversification compounds our urges to buy high and sell low.

We all understand that different asset classes perform better at different points in the cycling of the market, e.g. bonds typically do well when equities do poorly. By structuring your portfolio with a mixture of asset classes, you can achieve higher returns by removing some of the volatility thus ensuring we don’t panic sell at the wrong time or find ourselves in a margin call.

Understand your own risk profile and structure your investments accordingly. In portfolio construction, the rule of thumb is higher risks typically lead to higher returns. Not many investors are too concerned about achieving a greater than expected return when they’re in assets that are too high risk for their profile. However, higher peaks also lead to lower troughs and once again we find ourselves selling out of an investment that may be following its natural cycle.

Our online risk profiler can help you decide where you lie and offers suggestions on a suitable asset allocation. http://www.fundsfocus.com.au/managed-funds/risk-profiling.html

Consider capital protected products. By appealing to our tendency to favour certainty, these products can give us the impetus to invest at times when the market is low or remain invested in a fall. By removing the fear associated with investing or remaining in the market, we are able to make logical investment decisions without the impact of our emotional brain. We have covered this area extensively in this issue and how to differentiate the various product structures available.

Make regular payments instead of a lump sum payment. Planners talk about dollar cost averaging as a way of buying more units when prices go down. I have never understood the benefit because the opposite is also true. However, I do understand the psychological benefit in using a regular payment strategy and this is one of the keys to ensuring we feel good about our investments and that we buy at lower prices.

If we pay on a regular basis and the market rises then we feel good that we were clever enough to have invested already. If the market falls then we feel good that we are buying at lower levels. Either way, regular contributions ensures that we remain invested which any hardened investor will tell you is one of the best ways of achieving the best returns.

Comment: