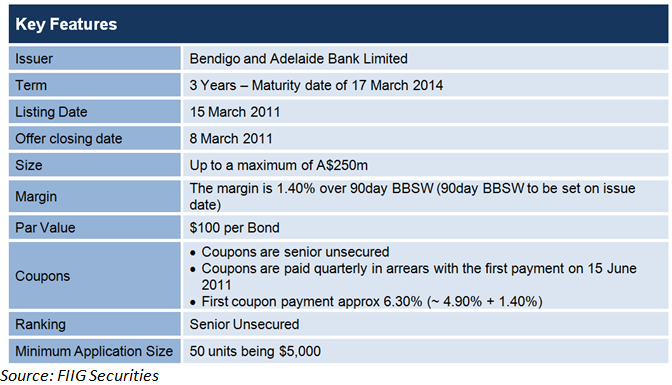

Bendigo and Adelaide Bank (Bendigo) recently announced the launch of a new retail bond: Bendigo and Adelaide Bank Retail Bonds Series 1 with a 3 year investment term.

market by issuing a security paying 1.40% over the 90 day bank bill swap rate (BBSW) for a three year term. The issue is another important step for the retail bond market and follows on from the Commonwealth Bank’s decision to issue a similar security last yea

The Bonds will pay a quarterly coupon of 1.40% over the 90 day bank bill swap rate (BBSW), 4.94% as of 22nd February, with an initial indicative rate of 6.34%. (The first quarter’s pricing is due to be set on date of issue) and will have a 3 year term. The bond will be tradable on the ASX.

In a similar vein to the CBA Retail bond issued in December, this latest issue highlights the increased cost of funding to banks and an opportunity for investors looking to lock in the higher rates currently being offered to investors on these issues.

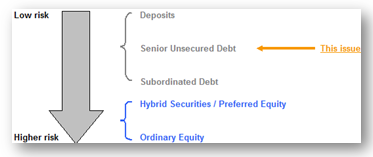

Prior to the GFC, banks were issuing hybrid securities (which retain substantially more risk than this bond) at similar margins to what is now being offered via the retail bonds coming to market. Compared to 2007, investors are receiving similar returns with greater security of capital.

Bank Bond Offers

With huge swathes of money currently sitting on deposit, many investors have naturally, compared the yields on offer to those available from their bank. We feel that the bank bonds currently being issued are reasonably attractive on a number of measures;

- Interest rests. Most term deposits for periods of 12-months or longer pay interest only once a year. Bonds typically pay interest (coupons) quarterly, meaning investors can reinvest their coupons quarterly to uplift their overall return.

- Liquidity. Listed bonds can be bought and sold easily on market without penalty*. A change in circumstances for a term deposit investor leading to an unexpected requirement for funds can mean a hefty claw back of interest (break fees) by the Bank if early access to the term deposit is required. Compare break fees for a five year term deposit if access is required after, say, two years, with the cost of selling your bonds via the ASX.

- Potential for capital gain. If the bond price rises above its issue price, the holder has the option of locking in a capital gain by selling his/her holding on the ASX. Several events, including a further tightening in credit spreads, could move the price higher.

- Benefit from rises in interest rates. Investors should take note whether the rate on offer is floating (variable) or a fixed rate bond. The recent issues have tended to favour floating rates, allowing investors to capture any further interest rate rises over the life of the bonds. Interest rates (coupons) on the bonds are typically tied to the 90-day Bank Bill Rate which moves up and down with the cash rate.

Benefits – Bendigo & Adelaide Bank Bonds

- Bendigo’s 3 year term deposits are currently 6.35% paid quarterly with financial penalties should you wish to exit early.

With the BBSW currently at 4.94%, the indicative first coupon on the retail bond will be 6.34%pa paid quarterly. The interest rate will be reset quarterly and should ensure that the interest rate will maintain parity with any increase in the RBA Official Cash rate.

- A quick look at the 3 year swap rates, shows them currently at 5.43%pa, indicating that investors can expect to receive an overall yield of 6.83%pa over the life of the Bond.

Key Risks

There are of course some risks associated with the Retail Bonds. While we regard the probability as low, there is always a chance that Bendigo could default on a payment and/or go to the wall. It should be noted that these securities rank behind term deposits in the event of insolvency.

Investors should also keep in mind that the bonds are a floating rate security. We generally regard this as a positive as coupons will increase if rates continue to rise as we expect. However, in the event that rates fall, so will the income from these securities. Another main risk is that in the event investors want to liquidate their holding they will be subject to the prevailing market price on the ASX.

Our view

Overall, the Bendigo & Adelaide Bank Retail Bonds are attractive relative to their current term deposit offering. The Retail Bonds offer a low risk security offering a rate of 1.40% over BBSW for a three year term. They are suited for investors who are looking for a defensive asset who also value the ability to liquidate the investment on short notice if required.

However, we feel that with the recent CBA Bond issued at 1.05% over the 90 day BBSW still sitting at around $100.30 the margin of 1.4% over BBSW 90 is very tight for an issuer of the quality of Bendigo and Adelaide Bank and would have preferred to have seen a margin of 1.6% or greater.

Regardless, investors looking to diversify and hold onto this bond for the 3 year term are likely to benefit relative to the yields currently offered by term deposit accounts.

*Note: Bendigo & Adelaide Retail Bonds will be listed on the ASX and as such the price of the Bond’s will be subject to market movements. Investor’s selling on market may receive a price lower (or higher) than the issue price. In the event of insolvency, term deposits rank higher than the retail bonds on the bank’s capital structure. The retail bonds rank above ordinary and preference share investors.

Best regards

Sulieman Ravell

Wealth Focus Pty Ltd

Comment: