CBA has just announced the launch of a new income offer: CommBank PERLS 11 Capital Notes (Notes). The first round of access is through a broker firm allocation, prior to a shareholder offer and listing in December.

Note: There is no General Offer of these securities.

The Notes will pay a quarterly coupon of 3.7%-3.9% (rate determined by the bookbuild) over the 90 day bank bill swap rate (BBSW), which was 1.93% as of 2nd November, with an initial indicative rate of 5.63%-5.83%pa. The initial rate is set on date of issue. The Notes are expected to redeem on the 26th April 2024** and will be tradable on the ASX under code CBAPH.

* It is expected that the issue will be repaid at the first opportunity in April 2024 with a scheduled Exchange in 2026 (subject to mandatory conditions not being breached).

Our analysis

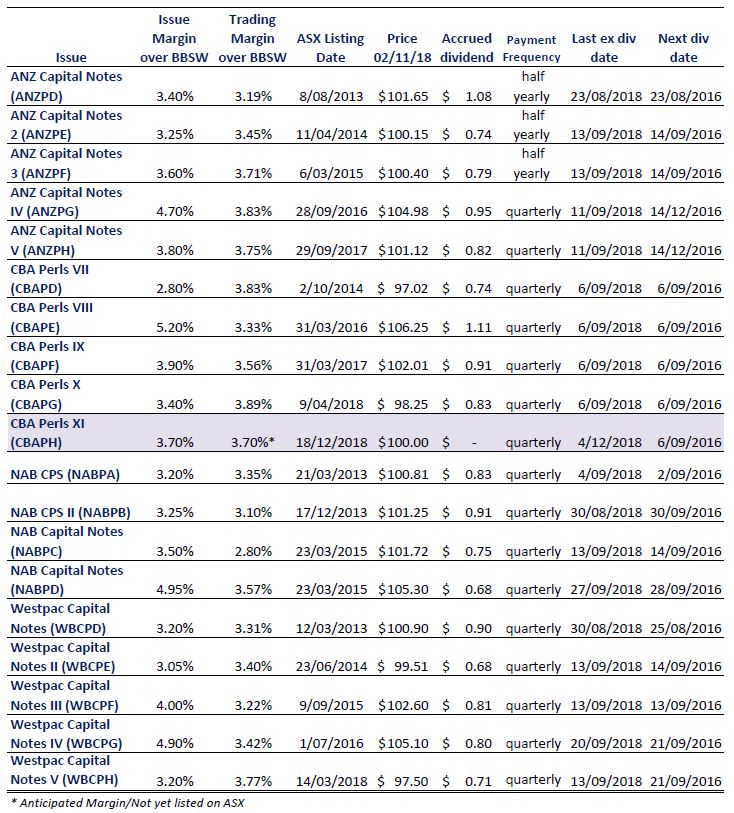

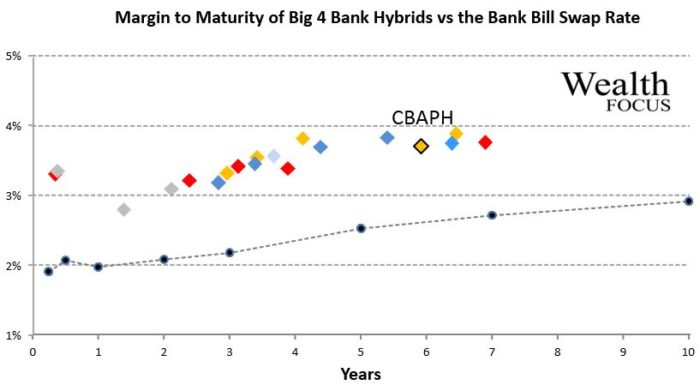

There has been very little new issuance over the last year. Spreads in the market have normalised with longer terms being reflected with wider spreads.

At a margin of 3.7% over the Bank Bill Swap Rate (BBSW), currently 1.93%pa, this issue sits in line with the current Big 4 bank spreads.

We view ANZ Capital Notes 4 (ANZPG) ANZ Capital Notes 5 (ANZPH), CBA PERLS 10 (CBAPG), and Westpac Capital Notes 5 (WBCPH) as the closest comparables, maturing in March 2024 – September 2025.

Non-viability Clause, Capital Trigger Event and Inability Event

Investors who are familiar with the new style hybrids we have seen over the last couple of years will be very aware of these clauses.

It is perhaps useful to understand that these clauses are as a result of APRA requiring further reassurance that in another GFC event, if required , hybrids would convert to ordinary equity, thereby reducing the bank’s debt costs and protecting deposit holders.

Now that banks have to hold a higher level of capital and a better quality loan book, it seems unlikely that any of these conditions would be breached, however, investors would do well to consider the increased disclosure and warnings within each prospectus over the last couple of years.

For those unfamiliar with the conditions, new hybrids now contain non-viability and capital trigger clauses that should the bank’s Tier 1 Capital Ratio fall below 5.125%, or APRA views the bank as non-viable without an injection of capital, the hybrids would automatically convert to ordinary shares.

We have also seen a gradual introduction of an Inability Event Clause added which states that in the event that the issuer is unable to issue further ordinary shares, ie the company has ceased trading, a Capital Trigger Event or Non-Viability Event, hybrid note holders lose their investment.

This is extremely unlikely, but investors would do well to remember the increase in yield offered carries additional risk.

Our View on CBA PERLS XI

We have maintained a cautious view over the non-viability clauses within new style hybrids, but this provides investors looking to switch equity allocation into a more stable alternative. (We do not consider hybrids a suitable alternative for fixed income/cash)

The increase in US rates has impacted the global cost of borrowing and are forecast to continue rising. Higher interest rates will likely present Investors with the dilemma of remaining in risk assets at a time that their valuations are being challenged or fleeing to safe haven assets such as bonds offering sub-standard yields. Interest rate rises are a headwind to both alternatives.

Floating rate notes such as hybrids may provide a suitable alternative for those looking to avoid the volatility of equities and the headwind of interest rate rises.

Labor attack on franking credits

We feel that the risk of a Labor Government attacking franking credits may provide some shorter term volatility in hybrid valuations as potentially dis-advantaged investors reset portfolios, but the market will likely normalise in the mid to long term.

Our view

We acknowledge that the margin of 3.7%-3.9% over BBSW is in-line with securities with similar vintages. Given the lack of issuance over 2018 and the fact that this issue is replacing an existing security CBAPC, we expect that there will be strong demand for securities.

Contact us if you would like an allocation to CBA PERLS 11 or have an existing investment in CBA PERLS 6 (CBAPC) you would like to roll into the new issue.

Key features

- Indicative floating yield of 5.63-5.83%pa – based on current 90 BBSW of 1.93% and bookbuild margin range of 3.7-3.9%.

- Option to redeem at year 5 with scheduled conversion at year 7 – CBA has the option to convert in April 2024 or on any subsequent dividend payment date.

- Ordinary dividend restrictions – applies on the non payment of CBAPH dividends

- Automatic conversion under the Capital Trigger Event and Non-Viability

- Redemption highly likely in 5.5 years – although CBAPH has a 7.5 year maturity, we feel it is likely CBA will redeem/convert at the first call date in April 2024. Major incentives for redemption/conversion include the potential for reputational damage and risk of credit rating downgrade, leading to an increased cost of funding on future debt issues.

Note: CBA PERLS 11 will be listed on the ASX and as such the price of the Note’s will be subject to market movements. Investors selling on market may receive a price lower (or higher) than the issue price.

Investors looking for an allocation can contact us on 1300 559 869

We encourage you to view our online presentation An Introduction to Fixed Income

Comment: