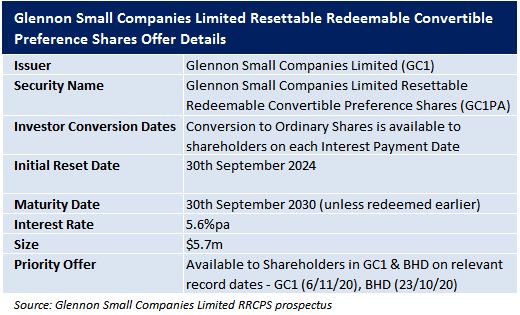

Glennon Capital Small Companies Ltd has recently announced the launch of a new income offer: GC1 RRCPS. Access is available through the Priority shareholder offer and a Broker Firm Offer before listing in December.

The RRCPS will pay a semi annual coupon at 5.60%pa with an initial reset date of 30th September 2024 and traded on the ASX.

Capital raised from this issue will be used to invest in securities listed on the ASX.

Disclosure: Sulieman Ravell is the author of this review and currently sits on the board of GC1 as a Non-Executive Director.

Glennon Capital

Glennon Capital Small Companies Ltd (GC1) is a Listed Investment Company that listed in 2015 and manage $37 Million (30/09/20). Funds raised will be used to invest with the existing portfolio of smaller companies (management fees of 1%pa + 20% performance fee over benchmark).

Comparables

This latest issue probably sounds familiar to regular readers, we have just reviewed the NAOS Ex-50 Opportunities Convertible Notes (NACG) and have previously written about the Clime Convertible Notes (CAMG).

Our view was that NACG offered a good risk reward profile and are likely to trade above their issue price, CAMG matures next year and whilst paying a 6.25%pa, it is now trading at a yield to maturity of 3.11%pa, illustrating the demand for good quality fixed income products in a low interest rate environment.

These products offer;

- The security of a bond like investment, paying 5.6%pa and allowing investors to redeem in 4 years.

- And the benefit by being able to convert to ordinary shares at a fixed price of $0.86 per share, approximately 18% above the share price on date of announcement.

Why the offer

Listed investment companies such as GC1 need to grow their market cap in order to dilute the fixed costs associated with running a Listed Investment Company.

Raising capital when the share price is at a discount, can dilute shareholders that don’t participate, making it very difficult for smaller companies with discounts to grow the company without diluting the shareholders that have supported them to date.

Convertible Preference Shares

One solution is to offer a Convertible Preference Share, effectively allowing GC1 to borrow money at 5.6%pa with the expectation that investors convert to ordinary shares should the share price return above 86c.

LICs are typically trading at larger discounts than they have historically and provide a tailwind for the conversion option.

With the market still trading approximately 10% lower than 12 months ago and GC1’s share price (72c) sitting at 14% below the cash Net Tangible Assets (NTA) (30/09/20) and the benefit of 6c in Deferred Tax Assets offsetting future tax liabilities, an 18% move in the share price over 4 years would seem readily achievable.

With the market still trading approximately 10% lower than 12 months ago and GC1’s share price (72c) sitting at 14% below the cash Net Tangible Assets (NTA) (30/09/20) and the benefit of 6c in Deferred Tax Assets offsetting future tax liabilities, an 18% move in the share price over 4 years would seem readily achievable.

Pricing

In our opinion, GC1PA looks attractive on a number of measures;

- 4 year term deposits are below 1.00% pa and are fixed for the period with financial penalties should you wish to exit early.GC1PA allow you to access a greater 4 year return at 5.6%pa with market liquidity should you wish to exit early (subject to market pricing).

- The conversion option is not dissimilar to having a (American Style) call option over ASX 300 for 4 years with a 18% hurdle. We would expect retail investors to pay close to 8% for this type of exposure, rounding the equivalent return to just under 7.5%pa (4 years).

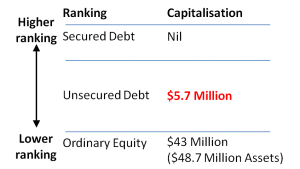

There is almost no debt and the company holds over $43 Million dollars in assets. An estimated $48.7 Mill after this raising. GC1 pledge that they will not issue security debt senior to RRCPS without RRCPS holders approval and will not allow the Loan to Value ratio to exceed 50%.

There is almost no debt and the company holds over $43 Million dollars in assets. An estimated $48.7 Mill after this raising. GC1 pledge that they will not issue security debt senior to RRCPS without RRCPS holders approval and will not allow the Loan to Value ratio to exceed 50%.

Impact of dilution to ordinary shareholders

As we highlighted in our review of NAOS Ex-50 Convertible Notes, there are naturally concerns over dilution in the NTA when options or a convertible note are issued. There are a significant number of variables that come into play. Primarily;

- the share price relative to NTA at time of exercise

- the timing of exercising conversion

- investment performance

The majority of RRCPS holders are unlikely to exercise if the share price remains below the exercise price of 86c, and if the share price rises relatively quickly, investors may look to exercise sooner rather than later, reducing the impact of potential dilution.

We’ve modelled some of the scenarios below. Notably, assuming 100% of RRCPS convert, the effect of dilution is relatively minor and in many cases accretive to shareholders.

Assumptions: GC1 dividends of 3c pa do not increase over the period shown, all RRCPS are converted at 4 years and excludes the impact of existing listed options

Our view

Although this is a Preference Share, the structure is relatively similar to the Clime Convertible Notes and NAOS Ex-50 Convertible Notes.

GC1 would need to lose approximately 85% in the value of their portfolio for RRCPS’ security to be impacted. Investors should take note that the portfolio invests in small and mid-cap stocks which can be more volatile.

There are a number of covenants to protect investors. Notably, events such as gearing exceeding 50%, and change of control events allow RRCPS holders to redeem.

Aside from investment risk, investors should note the size of this issue is relatively small and there is likely to be a lack of liquidity in the secondary market.

Overall, we think this provides an excellent risk reward profile and expect this to trade above its issue price. Clime Capital Notes are the closest comparable that are currently trading offering a Yield to the Maturity in 2021 of at 3.11%pa.

With only $5.7 Million available via the broker firm and priority shareholder offer to Glennon Small Companies Ltd (GC1) and Benjamin Hornigold Ltd (BHD) shareholders, we expect this offer to be heavily oversubscribed.

Notably investors looking to access this issue can still access the priority offer by purchasing GC1 shares on market to qualify before the record date.

Key features

- Fixed return of 5.6%pa – Paid half yearly in arrears

- Initial Reset Date in 4 years – Investors can elect to redeem 30th Sep 24

- Distribution Stopper – The issuer must not distribute assets of the company if the LTV ratio exceeds 50% for more than 10 business days.

- Ability to redeem in a trigger event or change of control –RRCPS holders can request redemption in the event of change of control or a trigger event such as LTV above 50%

- Option to convert –GC1 RRCPS to Ordinary GC1 shares at a fixed price of $0.86 per share during the 4 year term

- Semi-annual unfranked interest – Often overlooked by investors, hybrid returns are typically quoted inclusive of franking credits. Un-franked payments are more attractive as you avoid the need to wait until the end of the tax year to claim back the franking.

Note: GC1 RRCPS will be listed on the ASX and as such the price of the RRCPS will be subject to market movements. Investor’s selling on market may receive a price lower (or higher) than the issue price.

Comment: