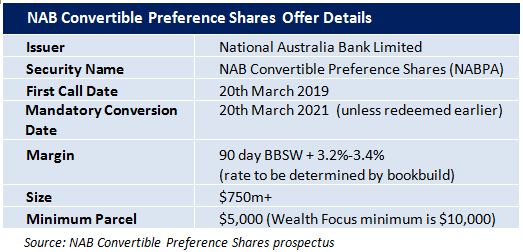

National Australia Bank has just announced the launch of a new income offer: NAB Convertible Preference Shares (CPS).The first round of access is through a broker firm allocation, prior to shareholder offer and listing in March.

The Notes will pay a quarterly coupon of 3.2%-3.4%pa (rate determined by the bookbuild) over the 90 day bank bill swap rate (BBSW), which was 3.03% as of 13th February, with an initial indicative rate of 6.23%-6.43%pa. (The first pricing is due to be set on date of issue) The Notes are expected to redeem on the 20th March 2019* and will be tradable on the ASX.

It is expected that the issue will be repaid at the first opportunity in March 2019 with a scheduled conversion in 2021 (subject to mandatory conditions not being breached).

Comparative Securities

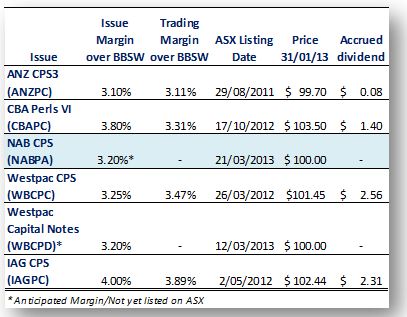

If you read our analysis on Westpac Capital Notes, you’re likely to find this sounding familiar. The structure is almost identical to the Westpac Capital Notes (WBCPD) issue and resembles many of last year’s issues CBA Perls VI (CBAPC), Westpac CPS (WBCPC) and ANZ CPS3 (ANZPC).

The CBAPC and WBCPD offer a margin over the 90 day BBSW, whereas ANZPC & WBCPC structures offer a margin over the 180 day BBSW. A rule of thumb dictates that a 90 day versus 180 day provides an additional 0.1%pa when annualising the returns.

The key difference with the recent issues versus historical bank hybrids issues has been the capital and non-viability clauses converting the hybrids to ordinary share in the event that the banks get themselves into trouble.

We view Westpac CPS2 (WBCPD) and Westpac Capital Notes (WBCPD) as the closest comparables for investors.

Non-viability Clause, Capital Trigger Event and Inability Event

We make no apologies for repeating ourselves here. We view these terms as the key risks in investing in these new bank hybrids and investors should familiarise themselves with these clauses.

Post GFC there has been a global emphasis on banks holding more capital on their balance sheets versus what they lend out and banks have historically used Hybrids as a way of funding their capital requirements. Their argument has been that push comes to shove, many of these hybrids (Notes/Convertible Preference Shares) are not a debt, that they are indeed a share that sits higher in the debt structure, hence the name Preference Share. However, investors have historically looked for additional security and the banks have been able to reassure investors with Mandatory Conversion Conditions. Unfortunately (or fortunately, depending on your view), APRA has gradually tightened up on what the banks can and can’t get away with when trying to call the money they have borrowed via hybrids, their own.

As a result we have seen the introduction of a Common Equity clause where IF the bank has less than 5.125% tier 1 capital (in layman’s terms, the amount of cash they hold on their books versus how much they are lending out), the hybrids would convert to ordinary shares. To provide some reference, the big four are typically holding around 7-8% tier 1 capital, which is up considerably from pre-GFC levels.

We have also seen the addition of the Non-Viability Clause which is a catch all that IF APRA views the bank as non-viable, the hybrids would convert to ordinary shares.

Increasing risk in the event the bank falls on hard times

As a result, we have moved on from older style bank hybrids where your main concern was IF (thats a big if) the bank was to go belly up, how much of your capital would you get back after the vast amounts paid out to deposit holders, senior and junior debt holders. Well, one thing is for sure, more than ordinary shareholders. In essence, you are giving up the expectation of growth in return for the expectation of a defined income. Fixed income return for fixed income risk.

Common Equity & Non Viability clauses were then introduced where IF the bank falls on hard times you could see yourself converted to become an ordinary shareholder, and in some instances this has a floor, so if the share price falls to $2.50 on conversion and the floor is $5, you have just lost half your capital. One thing we can tell you is IF you have just hit a common equity or non viability trigger, the bank will not be healthy, and the share price is likely to have been headed in one direction, and it isn’t up. Fixed income return for equity risk.

Furthermore, the most recent issues (post CBAPC) have then added an Inability Event, which states that IF the hybrids are converted at a time when the banks ordinary shares are not trading, you lose all your capital! Fixed income return for more than equity risk.

Note: NABPA’s Inability Event clause is more preferential, see below.

Our view

Lets be frank, those are some big IFs, they are very unlikely, but it just highlights that you need to keep an eye on these issues and the value of taking advice.

It’s not that we don’t like these hybrids, we just want to get paid a premium for the risk we’re taking. A cynic would say NAB are taking advantage of the lack of understanding among retail investors. We say they are running a business and marketing at the lowest rate they can get away with. Westpac raising $1.25 Billion at 3.2% over the BBSW only illustrates how desperate investors are for fixed income investments and what the market rate is. Furthermore the NABPA offer is slightly better as the Inability Event allows investors retain the right to a return of their capital in line with ordinary shareholders.

By contrast equity investors point to NAB dividend yields of over 8% plus growth, but dividends on equities are not guaranteed and capital values can vary significantly. Since the ASX200 pays around average of just over 5.5%, we would argue the market is saying contraction is more likely.

We’re certain that NAB CPS will be a success and raise its full quota at 3.2% over the BBSW, the lack of NAB hybrids means investors are more likely to pay a premium to achieve diversification in their hybrid portfolios. We would just like to see more premium to compensate you for the risk and as such, we are allowing those who are interested in an allocation to bid at prescribed margins. Ie X at any rate over 3.20%, Y at 3.30% and Z at 3.40% over the BBSW.

The flipside is you may be of the view that the banks are so well regulated that these will never be an issue, in which case, the added risk of these clauses will never come to light.

Like we said in our analysis of Westpac Capital Notes, you could always buy the existing WBCPD on market at wider margin (3.47% over the BBSW), but the brokers seem to have conveniently forgotten that. Perhaps a good litmus test for the quality of advice!!!

Key features

- Indicative floating yield of 6.23-6.43%pa – based on current 90 BBSW of 3.03% and bookbuild margin range of 3.20-3.40%. First payment due on 8th June 2013.

- Option to redeem at year 6 with scheduled conversion at year 8 –NAB has the option to convert in March 2019 or on any subsequent dividend payment date.

- Ordinary dividend restrictions –applies on the non payment of NABPA dividends

- Automatic conversion under the Capital Trigger Event and Non-Viability

- Redemption highly likely in 6 years –although NABPA has an 8 year maturity, we think NAB will redeem/convert at the first call date in March 2019. Major incentives for redemption/conversion include the potential for reputational damage and risk of credit rating downgrade, leading to an increased cost of funding on future debt issues.

Note: NAB CPS will be listed on the ASX and as such the price of the Note’s will be subject to market movements. Investor’s selling on market may receive a price lower (or higher) than the issue price.

Investors looking for an allocation can contact us on 1300 559 869

We encourage you to view our online presentation An Introduction to Fixed Income

Best regards

Sulieman Ravell

Wealth Focus Pty Ltd

Comment: