Building a better future

Favoured by many investors for their tax deferred income, unlisted property funds have once again come to investor attention after they have continued to provide returns in a falling market.

With the recent increase in volatility over the last year or so, and poor returns across most asset classes, investors have begun to reassess their portfolios and how diversification can provide returns in uncertain times.

The impact of the Sub-Prime crisis in the US has been so severe it is being felt all around the world. Whilst this mainly impacts the financial institutions underwriting the sub-prime home loans this has created uncertainty in the markets and as a result we have seen some significant falls in the equity markets. My view is that change creates opportunity and recently we have seen some significant changes in the way the stockmarket is behaving, where the opportunity lies is the question that investors need to ask themselves.

I’m a big advocate of diversifying your portfolio and providing a balanced spread across numerous asset classes. Over exposing yourself to one asset class not only increases the risks your taking but opens you up to emotional investing, buying when prices are high and selling out when prices are low. It is therefore important that investors consider investments such as property that have little or no correlation to the markets.

Listed or unlisted?

Current indicators show that the health of the Australian property market is heading in the right direction. The property sector shows a low level of vacancies and high rental growth, the economy is strong and the Reserve Bank is focused on keeping inflation under control.

The key question for many investors is, what is the best way to gain exposure to property within an investment portfolio? Do you use Listed Property Trusts (LPTs, now referred to as Australian Real Estate Investment Trusts or A-REITs) or unlisted direct property funds?

For many investors, the recent poor performance of LPTs over the last year has come as something of a surprise. Usually considered a relatively safe asset class the LPT sector has fallen 33.2% in the 12 months to 30 May 2008. Comparatively, the ASX 300 fell by 6.7% for the same period, which perhaps further illustrates some of the intrinsic differentiators of LPTs from unlisted direct property funds, ie LPTs behave a lot like equities and in the same way are at the mercy of investor sentiment.

Whilst the main reason for the fall in the price of LPTs has generally been attributed to falls in the stockmarket, some are highly geared, struggling with the increasing cost of lending, and some have diversified into overseas higher risk property including the US and its associated sub-prime problems. As a result, LPTs fall in price is little or nothing to do with the assets owned. However, this all leads to uncertainty, and one thing the markets don’t like is uncertainty.

There are many LPTs trading below their underlying asset value. This presents opportunities, although, you need to be careful as there may be one or two more skeletons to come out of the sub-prime closet. Problems in raising capital and restructuring short term debt mean that many LPTs are unlikely to be in a position to take advantage of property investment opportunities and may impact on investor returns.

Simple investment philosophy dictates that you should “never catch a falling knife”. Until the recent volatility and liquidity issues are rectified, uncertainty remains over whether LPTs have further to fall and we currently favor direct unlisted funds for investors looking to property.

Unlisted Property Funds – Investment returns without stockmarket sentiment

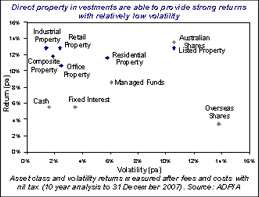

In contrast, unlisted property’s relatively low volatility is attractive to risk averse investors. Unlike LPTs, unlisted property allows investors to gain exposure to property without the impact of equity market sentiment.

In light of recent market volatility, investors looking to diversify their portfolio using assets that have little correlation to stockmarket investments would do well to consider unlisted property.

As the impact of increased difficulty in refinancing and LPT market sentiment starts to bite, we expect some funds to find it more difficult to invest in new assets and in some cases, force the sale of property. As a result funds with cash in the bank, low levels of gearing and those having recently refinanced are a much more attractive investment.

Generally speaking, the Australian property market has changed very little over the last year and continues to provide a good investment opportunity. Despite the difficulties that some companies faced over the last year we aren’t in a property slump, there continues to be strong demand for high quality property.

Cromwell (unlisted) Property Fund

We believe that one of the best ways of diversifying your investments and gaining exposure to property is through the Cromwell Property Fund (CPF), an unlisted fund providing tax deferred monthly distributions.

Managed by Cromwell Property Securities Limited (ABN 11079147809, AFSL 238052), their flagship fund invests in a diversified portfolio of non-residential assets including commercial, industrial and retail properties located throughout Australia. With a total value of $465m, the fund’s heavy weighting of government and blue chip tenants further reduces investment risk by providing a relatively reliable rental income.

To October 2007, Cromwell has a good record of out-performing industry benchmarks with an average annualised return of 18.64%1 across nine other syndicates, outperforming the Mercer Unlisted Property fund index since inception.

Paying a competitive 8 cents per unit (fully tax deferred) and with a unit price currently under $1.00, the CPF is one of the few unlisted property funds that can deliver both a pure property yield and give investors an exposure to relatively low risk value-add opportunities.

We believe that a major demonstration of Cromwell’s strength as a manager is their recent refinancing of the CPF’s debt on extremely favourable terms. With many property funds and businesses struggling to refinance their existing debt facilities, Cromwell’s recent refinancing of their loans at less than 0.1% pa above existing terms for the next 3 years means that unlike many other market players, the fund is unlikely to need to look at selling assets and can focus on adding value to investors.

With little correlation to recent market movements we believe that unlisted property is an ideal way to diversify and add some stability and income to investors’ portfolios. We believe that the Cromwell Property Fund makes an excellent long term choice.

1Page 13, Lonsec Research Report on CPDF (October 2007)

2Current MER disclosed for the 2008 financial year

Comment: