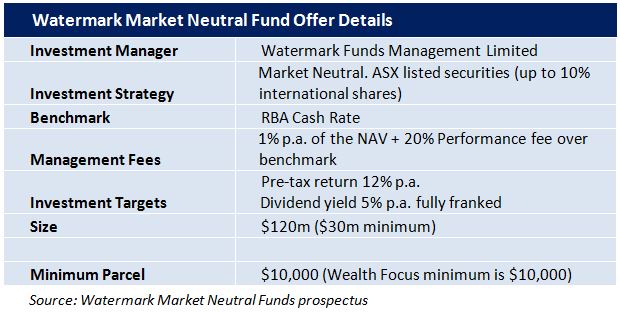

Watermark has announced the launch of a new Listed Investment Company: Watermark Market Neutral Fund (WMK).The first round of access is through a broker firm allocation, prior to the shareholder & general offer and listing in June.

The Shares aim to provide investors with a 12% pre tax return and pay a 5% fully franked dividend (subject to available franking credits). The Shares will be tradable on the ASX.

This issue is the launch of a market neutral strategy from the manager of Australia’s best performing Listed Investment Company* (ALF) with the aim of providing investor return regardless of market movements.

Watermark currently managed a successful LIC, Australian Leaders Fund (ASX code: ALF) and we have referenced this investment in our analysis of the offer and we feel investors would do well to familiarise themselves with ALF in making a decision on whether to invest in Watermark Market Neutral Fund. We have been a long term holder of ALF within our client portfolios and are very familiar with the management team and their style.

Watermark’s latest fund launch is a direct result of the demand we saw for ALF via the placement in March which was upsized significantly and remained 2-3 times oversubscribed. We weren’t surprised however as their investment returns have been nothing short of spectacular and a direct result of their alpha generation via stock picking abilities.

With medium term market conditions continuing to look subdued, demand has risen for Watermark’s stock picking ability in a fund that remains market neutral. ie it holds an equal number of long (makes money if a share price rises) and short (makes money of a share price falls) positions. As a result, the primary risk moves away from market movements, that is, the beta part of the return equation is removed and the focus is on Watermark’s ability to pick shares.

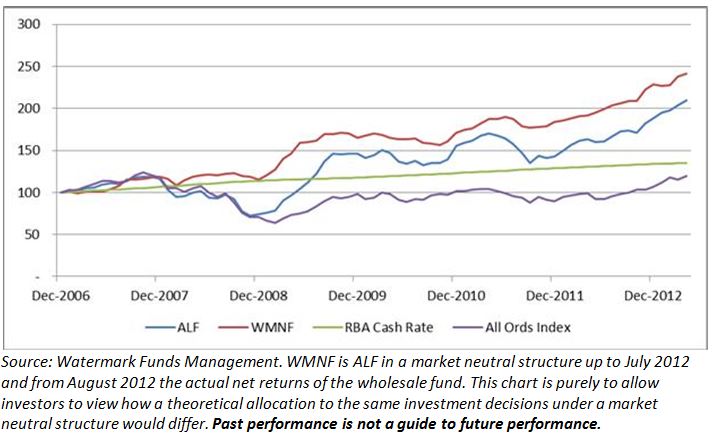

Indeed an analysis of ALF’s investment performance (NTA) versus a market neutral position shows less volatility and a better return for investors since Dec 2006 (when ALF started providing data for its long versus short portfolios).

However, we should note that in a rising market we would expect ALF to outperform due to the natural bias to be long within its portfolio.

Key Features

- Limited Offer – The offer is to raise $120 Million, with the ability to raise less. The shares will be traded on the ASX.

- Market Neutral Strategy – Whereas many managed funds aim to target outperformance relative to a benchmark such as the ASX 200 and naturally carries the risk of the overall market falling, WMK aims to provide returns independent of movements in the index.

- Free option – Each investor will receive a free option for each share subscribed to in the IPO.

- Targeted return –The company is targeting an investment return of 12%pa

- Dividends –The company aims to return 5%pa to investors plus franking (where franking credits are available)

What we like

- Investment Pedigree – As manager of the best performing LIC (since inception), we feel Watermark have demonstrated their ability to stock pick, which is arguably the key risk within this investment strategy.

- Free option– Each investor will receive a free option for each share subscribed to in the IPO. Exercisable at $1, we value the option at between 6c-10c.

- Market Neutral Strategy– We have long held the view that markets are in for a rough time for the foreseeable future. Good quality long only managers are still going to struggle in a sideways or falling market. A market neutral strategy provides potential upside all market conditions. E.g. the unlisted (wholesale) market neutral fund increased by approximately 8% in May when the All Ordinaries Accumulation Index fell 4.39%.

What we don’t like

- Listed Investment Companies often trade at a discount to NTA – Although we feel this is likely to become less of an issue from the 1st July when commissions are banned and financial planners are therefore more likely to consider LICs. The discount to NTA is worth noting. Historically LICs can be expected to trade at a premium during a falling market and a discount in a rising market as investor attitudes to the high yield typically on offer changes. Better performing and more established managers are more likely to trade at a premium and vice versa. ALF currently trades at a premium to the underlying NTA.

- Watermark’s funds under management has grown significantly over the last few months. We wonder whether this will impact on their performance as they may not be able to source enough stock.

Our view

Overall we believe market neutral strategies are suited to the current economic environment where insightful research can lead to profiting from mispricing in equity markets. This is an excellent offering from a manager that has consistently demonstrated their ability to outperform. In the current market conditions, and looking at ALF (currently trading at a premium), we feel it unlikely that the shares will trade at a meaningful discount and our concern is offset with the free option for initial subscribers.

Note: Watermark Market Neutral Fund will be listed on the ASX and as such the price will be subject to market movements. Investor’s selling on market may receive a price lower (or higher) than the issue price.

Investors looking for an allocation can contact us on 1300 559 869

Best regards

Sulieman Ravell

Wealth Focus Pty Ltd

Comment: