National Australia Bank has just announced the launch of a new income offer: NAB Convertible Preference Shares (CPS) II.The first round of access is through a broker firm allocation, prior to shareholder offer and listing in December. The Notes will pay a quarterly coupon of 3.25%-3.4%pa (rate determined by the bookbuild) over the 90 day bank bill swap rate (BBSW), which was 2.59% as of 13th November, with an initial indicative rate of 5.84%-5.99%pa. (The first pricing is due to be set on date of issue) The Notes are expected to redeem on the 19th December 2022* and will be tradable on the ASX.

It is expected that the issue will be repaid at the first opportunity in December 2020 with a scheduled conversion in 2022 (subject to mandatory conditions not being breached).

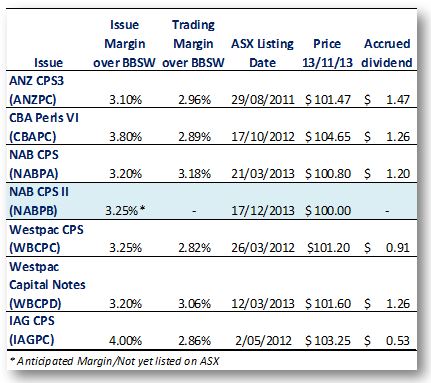

Comparative Securities

The closest comparables are NAB CPS (NABPA) and Westpac Capital notes (WBCPD), which were issued earlier this year and resembles many of the issues we’ve seen over the last 18 months. The key difference in this issue is the longer term of a further 18 months to maturity. The CBAPC, NABPA and WBCPD offer a margin over the 90 day BBSW, whereas ANZPC & WBCPC structures offer a margin over the 180 day BBSW. A 90 day rate provides around another 0.1% pa when annualising the returns. We view NAB CPS (NABPA), Westpac CPS2 (WBCPD) and Westpac Capital Notes (WBCPD) as the closest comparables for investors.

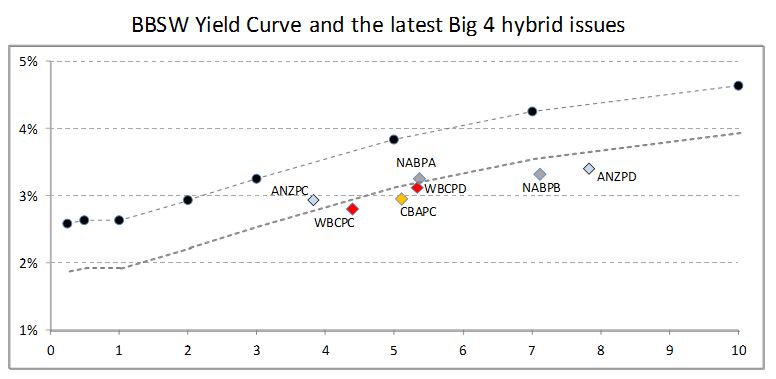

Our analysis NABPA currently trades at $100.80 including a $1.20 accrued dividend (ex. div on 29th August 2013), with an effective margin to expected maturity of 3.22%pa. Similarly WBCPD trades at an effective margin of 3.06%pa over the BBSW. As we highlighted in our analysis of ANZ Capital Notes earlier this year, the main difficulty in considering the newer issues versus the existing issues on market is the longer duration and how much you should be rewarded for tying up your capital for a longer period. One way of considering this is to use the Bank Bill Swap Rate (BBSW), the rate that banks’ lend money to each other at, and provides a reasonable basis of how much you should expect to be rewarded for the extra duration. We can then compare this to some of the other listed issues among the Big 4 and consider whether NABPB offers value relative to other issues on market. Although we have a preference for issues without the Non-viability and Inability Event clauses, this analysis would indicate 3.40% is a fair margin. If we further factoring in that the wholesale market yield curve is slightly flatter, we would assess a fair margin as 3.30% over the BBSW

Non-viability Clause, Capital Trigger Event and Inability Event

Investors should note that all of the recent bank hybrid’s now contain non-viability and capital trigger clauses that should the bank’s Tier 1 Capital Ratio fall below 5.125% or APRA views the bank as non-viable without an injection of capital, the hybrids would automatically convert to ordinary shares. The most recent bank hybrids have seen a further Inability Event Clause added which states that in the event that the issuer is unable to issue further ordinary shares, ie the company has ceased trading, a Capital Trigger Event or Non-Viability Event, hybrid note holders lose all their investment. Notably, NABPA and NABPB offer a slightly preferential conversion which provides investors with a claim equal to ordinary shareholders. Although this is extremely unlikely this reflects the continued increase in risk of the latest bank hybrid offerings. Investors should ensure they get paid a premium for the additional risk they are taking. For those looking for view of how much you should be getting paid for this additional risk – It is our view that the institutional investors have generally got a good handle on how much you should be rewarded. The institutional market prices this at around 0.3%pa.

Our View on NAB CPS II Some brokers are of the view that this is the opportunity to lock in historically high margins as it seems likely that yields will continue to contract. As advisers, it is our view that you need to be rewarded for the additional risk and term and we would like to see a margin in excess of 3.3% over the BBSW. Overall, we don’t think there is much meat on this one but the lack of recent hybrid issues means we are certain that NAB will successfully raise the funds they are looking for (and probably a lot more) at the bottom end of the range (3.25%-3.40% over the 90 day BBSW).

Key features

- Indicative floating yield of 5.84-5.99%pa – based on current 90 BBSW of 2.59% and bookbuild margin range of 3.25-3.40%. First payment due on 8th June 2013.

- Option to redeem at year 6 with scheduled conversion at year 8 –NAB has the option to convert in March 2019 or on any subsequent dividend payment date.

- Ordinary dividend restrictions –applies on the non payment of NABPB dividends

- Automatic conversion under the Capital Trigger Event and Non-Viability

- Redemption highly likely in 7 years –although NABPB has an 9 year maturity, we think NAB will redeem/convert at the first call date in December 2020. Major incentives for redemption/conversion include the potential for reputational damage and risk of credit rating downgrade, leading to an increased cost of funding on future debt issues.

Note: NAB CPS II will be listed on the ASX and as such the price of the Share’s will be subject to market movements. Investor’s selling on market may receive a price lower (or higher) than the issue price. Investors looking for an allocation can contact us on 1300 559 869

We encourage you to view our online presentation An Introduction to Fixed Income

Best regards

Sulieman Ravell

Wealth Focus Pty Ltd

Comment: