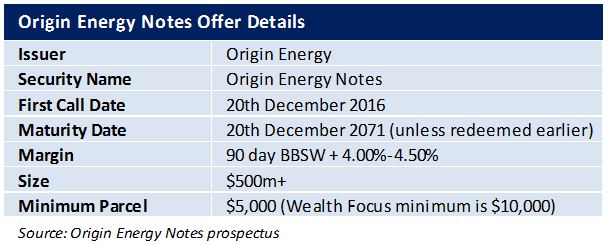

Origin Energy has just announced the launch of a new income offer: Origin Energy Notes.The first round of access is through a broker firm allocation, prior to shareholder offer and listing in December.

The Bonds will pay a quarterly coupon of 4.00%-4.50% over the 90 day bank bill swap rate (BBSW), 4.59% as of 17th November, with an initial indicative rate of 8.59%-9.09%pa. (The first quarter’s pricing is due to be set on date of issue) and are expected to redeem 20th December 2016*. The bond will be tradable on the ASX.

This issue will be used primarily to assist in funding Origin’s contribution to the Australia Pacific LNG project.

Although this is a 60 year bond, it is expected that the issue will be repaid at the first opportunity in December 2016. We feel it unlikely the issue would continue after this date as the Notes would expected to be treated as debt by credit ratings agency, S&P, if it is not redeemed at this date. The issue is treated as equity for the first 5 years which assists Origin in lowering their overall funding costs.

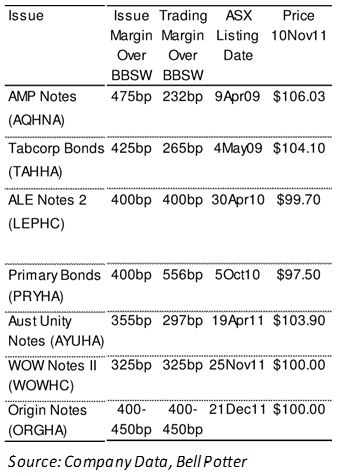

Comparative Securities

It’s only natural to make comparisons with other issues such as the recent, and heavily oversubscribed, Woolworths Notes II issue (WOWHC).

Overall, the ORGHA structure is similar to the WOWHC issue. The key difference is a higher margin on ORGHA as a result of Woolworth’s higher credit rating. ORGHA has a longer term to maturity (60 years versus 25 years) and a longer step-up (25 years versus 5 years). However, investors should note the mandatory interest deferral if ORG’s S&P credit rating falls three notches from its current level of BBB+ Stable outlook to below investment grade (BB+).

Key Points

- Indicative floating yield of 8.59%-9.09% provides investors the opportunity to take advantage of historically high hybrid margins.

- Interest protected – Although the issue terms allow for deferral of ORGHA interest payments at Origin’s discretion for up to 5 years, investors are protected by the dividend stopper requiring non payment of ordinary dividends.

- Mandatory deferral of interest – If Origin’s S&P corporate credit rating falls below investment grade, mandatory deferral of interest will apply. This will occur under the unlikely scenario that Origin’s credit rating falls at least three notches and the company does nothing to strengthen its balance sheet. See update below

- Financial Strength – ORGHA provides investors exposure to one of the largest companies listed on the ASX and a market cap of over $15.5bn.

- Credit Rating – It should be noted that ORGHA has heavy incentives to maintain a high credit rating. Lower credit ratings lead to higher cost of capital on further issues and we note that the supply of energy contracts are likely to be dependent on maintaining a high rating. An important aspect of this issue is that S&P only provides 100% equity credit for the first 5 years, after which it would be considered to be debt and likely to impact on Origin’s credit rating. We therefore expect this issue to be repaid in 5 years.

Our View

The current demand for fixed income investments means that Origin Energy is likely to issue at 4.00% over the BBSW, an attractive premium in an absolute sense when compared to recent issues such as Woolworths Notes (3.25% over the 90 day BBSW) and ANZ CPS3 (3.10% over the 180 day BBSW). However, investors should note that this is a trade off of risk versus return. Origin Energy is a cash hungry company with much of their anticipated future success reliant on the Australia Pacific LNG (APLNG) project in Queensland. Although seemingly unlikely, should the company have trouble executing their strategy and see a significant fall in their credit rating, investors could potentially find themselves holding Notes that have either deferred interest payments and/or not repaid debt at the first opportunity in December 2016.

We feel this issue is fairly priced at this stage, the higher income reflects the added risk when investing in a company like Origin Energy. Our advice is to research Origin before investing in this issue.

Note: Origin Energy Notes will be listed on the ASX and as such the price of the Bond’s will be subject to market movements. Investor’s selling on market may receive a price lower (or higher) than the issue price.

UPDATE 30th November 2011

Origin Energy have reissued their prospectus as a result of query from ASIC relating to the wording on the mandatory dividend stopper.

The issue was primarily that the dividend stopper referred to a drop in 3 notches on the S&P credit rating. Since S&P ratings cannot be quoted prospectus’s used for retail investors, it could be argued that investors have no reference to understand the drop in credit rating.

Origin have therefore re-issued the prospectus and the mandatory dividend stopper now refers to Origin’s level of, and ability to service debt (Interest Cover Ratio and Leverage Ratio). This is similar to where we would expect the debt to be leading to a drop of 3 notches on an S&P credit rating and have not changed our overall view of this offer.

Pricing was set on the 1st December at 4% over the 90 day BBSW (4.52% 30/11/11) for an indicative rate of 8.52%pa.

Best regards

Sulieman Ravell

Wealth Focus Pty Ltd

Comment: